Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,405

- Nation

- Axis Group

RMG exports grow 18% in Oct-Dec

Bangladesh’s readymade garments (RMG) industry has continued to expand despite global economic challenges and domestic labour unrest following the fall of the Awami League government last August, according to the latest Bangladesh Bank (BB) report.

RMG exports grow 18% in Oct-Dec

Bangladesh's readymade garments (RMG) industry has continued to expand despite global economic challenges and domestic labour unrest following the fall of the Awami League government last August, according to the latest Bangladesh Bank (BB) report.

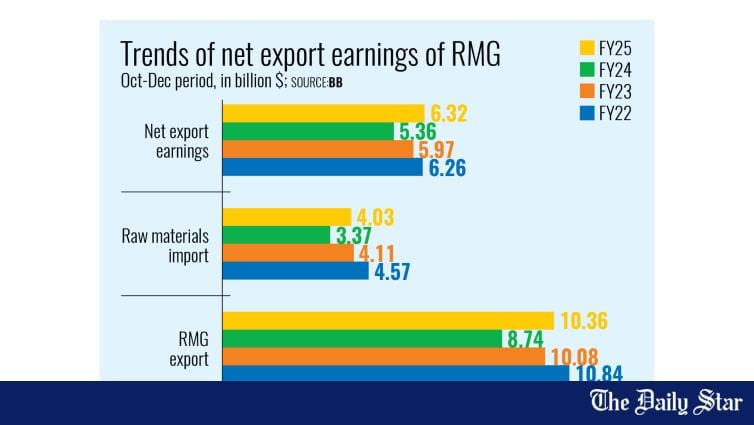

Export earnings for the October-December period of fiscal year 2024-25 (FY25) stood at $10.36 billion, marking a 9 percent increase from the previous quarter.

Year-on-year, it was a growth of 18.6 percent.

"This growth was attributed to the rebound of economic activities in advanced economies along with the peak holiday shopping season in Western markets," said the central bank's quarterly review of RMG released yesterday.

Major US and European retailers typically increase their orders to meet consumer demand, it said.

The report said the apparel sector faced inflationary pressure, disruptions to supply chains, fluctuating fuel prices, and rising transportation costs. However, demand from key export markets remained strong.

Last year, the local garment sector witnessed demonstrations, national election-related movements, factory closures and production halts amid massive labour unrest after the fall of the Sheikh Hasina-led administration on August 5.

Goods shipment was severely affected in July, August, September and October due to a student-led mass movement culminating in Awami League's ouster and widespread labour unrest demanding wage hikes and an end to workplace discrimination.

On the international front, high inflation has persisted over the past few years because of the far-reaching implications of the Russia-Ukraine war that began just after the pandemic, affecting consumer demand.

But Western economies have been rebounding gradually with rising demand, for which retail sales have also been growing with the clearance of inventories of previous years in Europe and the US.

"Over the years, Bangladesh has established itself as one of the world's leading apparel manufacturers," it said.

"The growth of this sector can be attributed to competitive labour costs and a robust supply chain network," the report added.

The RMG sector contributed 11.68 percent to the gross domestic product (GDP) during the quarter.

The BB report said nine countries -- namely the US, Germany, the UK, Spain, France, the Netherlands, Italy, Canada, and Belgium -- were the primary destinations for Bangladesh's RMG exports.

These countries enabled roughly 70 percent of total RMG earnings in the second quarter of FY25.

Earnings from these markets increased by 7.13 percent compared to the preceding quarter.

Of the shipments, knitwear exports grew by 2.61 percent quarter-on-quarter to $5.48 billion.

The growth was 18 percent compared to the same quarter of the previous year, driven by strong demand from the US and European Union.

Woven garment exports rose by 17.23 percent to $4.88 billion, supported by increased consumer spending in the European and US markets.

The BB report said woven garment exports experienced notable growth, leading to a resurgence in consumer spending in major markets, particularly in Europe and the US.

"This uptick was influenced by economic recoveries and a renewed interest in apparel. Moreover, a competitive edge through cost-effective production has been maintained, offering quality woven garments at attractive prices," it said.

The report said the RMG sector continues to be affected by supply chain disruptions and increased raw material costs.

The import value of raw materials such as cotton, synthetic fibres, yarn, and textile fabrics reached $4.03 billion in the second quarter of FY25, accounting for 39 percent of total RMG export earnings.

Net export earnings stood at $6.32 billion, a 12.67 percent rise from the previous quarter.

The BB report said Bangladesh's RMG sector demonstrated strong resilience and steady growth during the October-December period of FY25, driven by increased global demand and production efficiency.

"Looking ahead, the significant performance of the RMG sector will be reaffirmed during the whole of FY25, setting a positive outlook for the coming years and positioning Bangladesh as a leading apparel exporter on the global stage," the report said.

Bangladesh's readymade garments (RMG) industry has continued to expand despite global economic challenges and domestic labour unrest following the fall of the Awami League government last August, according to the latest Bangladesh Bank (BB) report.

Export earnings for the October-December period of fiscal year 2024-25 (FY25) stood at $10.36 billion, marking a 9 percent increase from the previous quarter.

Year-on-year, it was a growth of 18.6 percent.

"This growth was attributed to the rebound of economic activities in advanced economies along with the peak holiday shopping season in Western markets," said the central bank's quarterly review of RMG released yesterday.

Major US and European retailers typically increase their orders to meet consumer demand, it said.

The report said the apparel sector faced inflationary pressure, disruptions to supply chains, fluctuating fuel prices, and rising transportation costs. However, demand from key export markets remained strong.

Last year, the local garment sector witnessed demonstrations, national election-related movements, factory closures and production halts amid massive labour unrest after the fall of the Sheikh Hasina-led administration on August 5.

Goods shipment was severely affected in July, August, September and October due to a student-led mass movement culminating in Awami League's ouster and widespread labour unrest demanding wage hikes and an end to workplace discrimination.

On the international front, high inflation has persisted over the past few years because of the far-reaching implications of the Russia-Ukraine war that began just after the pandemic, affecting consumer demand.

But Western economies have been rebounding gradually with rising demand, for which retail sales have also been growing with the clearance of inventories of previous years in Europe and the US.

"Over the years, Bangladesh has established itself as one of the world's leading apparel manufacturers," it said.

"The growth of this sector can be attributed to competitive labour costs and a robust supply chain network," the report added.

The RMG sector contributed 11.68 percent to the gross domestic product (GDP) during the quarter.

The BB report said nine countries -- namely the US, Germany, the UK, Spain, France, the Netherlands, Italy, Canada, and Belgium -- were the primary destinations for Bangladesh's RMG exports.

These countries enabled roughly 70 percent of total RMG earnings in the second quarter of FY25.

Earnings from these markets increased by 7.13 percent compared to the preceding quarter.

Of the shipments, knitwear exports grew by 2.61 percent quarter-on-quarter to $5.48 billion.

The growth was 18 percent compared to the same quarter of the previous year, driven by strong demand from the US and European Union.

Woven garment exports rose by 17.23 percent to $4.88 billion, supported by increased consumer spending in the European and US markets.

The BB report said woven garment exports experienced notable growth, leading to a resurgence in consumer spending in major markets, particularly in Europe and the US.

"This uptick was influenced by economic recoveries and a renewed interest in apparel. Moreover, a competitive edge through cost-effective production has been maintained, offering quality woven garments at attractive prices," it said.

The report said the RMG sector continues to be affected by supply chain disruptions and increased raw material costs.

The import value of raw materials such as cotton, synthetic fibres, yarn, and textile fabrics reached $4.03 billion in the second quarter of FY25, accounting for 39 percent of total RMG export earnings.

Net export earnings stood at $6.32 billion, a 12.67 percent rise from the previous quarter.

The BB report said Bangladesh's RMG sector demonstrated strong resilience and steady growth during the October-December period of FY25, driven by increased global demand and production efficiency.

"Looking ahead, the significant performance of the RMG sector will be reaffirmed during the whole of FY25, setting a positive outlook for the coming years and positioning Bangladesh as a leading apparel exporter on the global stage," the report said.