Saif

Senior Member

- Messages

- 17,442

- Likes

- 8,381

- Nation

- Residence

- Axis Group

Bangladesh’s 801 export-oriented enterprises at high risk

More than 800 Bangladeshi export-oriented enterprises may face a significant amount of risk following the United States’ announcement of reciprocal tariffs on goods produced in Bangladesh. Exporters warn that unless the additional tariffs are negotiated and reduced, exports to the US could face...

Trump’s tariff

Bangladesh’s 801 export-oriented enterprises at high risk

Masud MiladChattogram

Published: 09 Jul 2025, 12: 27

Containers at Chittagong Port Prothom Alo file photo

More than 800 Bangladeshi export-oriented enterprises may face a significant amount of risk following the United States’ announcement of reciprocal tariffs on goods produced in Bangladesh. Exporters warn that unless the additional tariffs are negotiated and reduced, exports to the US could face serious setbacks.

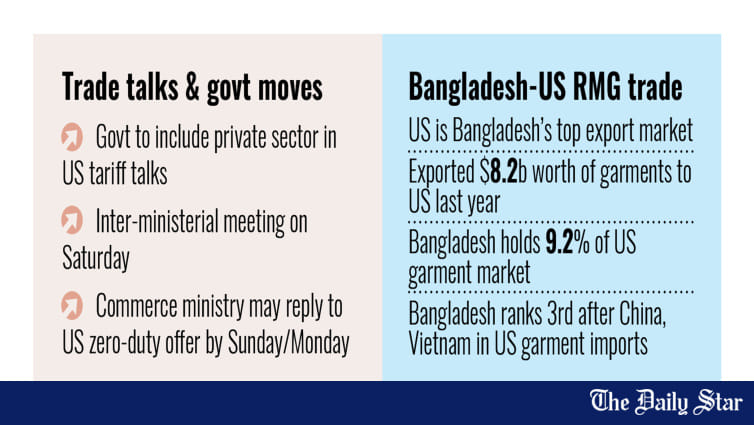

US President Donald Trump on Monday announced a 35 per cent reciprocal tariff on Bangladeshi goods, which is set to come into effect from 1 August. This declaration has sparked concern among more than 2,000 Bangladeshi exporters with active trade links to the US.

Many of those firms also export to other countries. However, a number of them rely solely on the US market for their shipments.

An analysis of data from the National Board of Revenue (NBR) reveals that as many as 2,377 companies exported 1-100 per cent of their products to the US during the 2024–25 fiscal year. Among them, 801 companies sent more than 50 per cent of their total exports to the US, making them particularly vulnerable due to their overreliance on a single market.

Collectively, those 801 companies exported USD 6.62 billion (662 crore) worth of goods globally last fiscal year. Of which USD 5.05 billion (505 crore), or 58 per cent, of Bangladesh’s total exports went to the US.

Bangladeshi goods are already subject to tariffs 10–15 per cent higher than those from competing countries. This effectively means we are going to lose the US market. Buyers from the US are also already worried.

Mohammad Abdus Salam, managing director of Chattogram-based Asian & DAF Group

In total, Bangladesh exported goods worth USD 8.76 billion (876 crore) to the United States in the last fiscal year, including USD 7.59 billion (759 crore) in ready-made garments alone.

Garment sector faces the greatest threat

Chattogram-based Fortune Apparels, located in Nasirabad, exported garments worth USD 33.7 million (3.37 crore) last fiscal year, all of that was to the United States. Fortune Apparels is a sister concern of the Asian & DAF Group.

Speaking to Prothom Alo, Mohammad Abdus Salam, managing director of the group, said Bangladeshi goods are already subject to tariffs 10–15 per cent higher than those from competing countries. This effectively means we are going to lose the US market. Buyers from the US are also already worried. “If the tariffs aren’t reduced, they will move their sourcing elsewhere.”

Fortune Apparels is one of 168 companies that export exclusively to the US. If the new tariff takes effect, these firms could face existential threats, industry leaders warn.

Even companies that export the majority of their products to the US are also in a precarious position. One such firm is Independent Apparels, also based in Nasirabad of Chattogram. In the last fiscal year, 89 per cent of its exports were destined for the US.

Aside from garments, Bangladesh exports footwear, headgear, tents, bags, furniture, and food products to the US. Of the exporting companies, 176 were entirely dependent on the US market last fiscal year.

Speaking about this, Independent Apparels Ltd. managing director SM Abu Tayeb said, “We’ve been working with US buyers for nearly three decades. Retail giants like Walmart have put their trust in us. But if we must pay an additional 35 per cent on top of the existing 15 per cent tariff, totalling 50 per cent, then US buyers will no longer be interested in sourcing from Bangladesh. We’re looking to the 9 July bilateral meeting with the US (for a solution).”

BGMEA (Bangladesh Garment Manufacturers and Exporters Association) first vice-president Selim Rahman observed that there could be risks in the alternative markets to the US.

He noted, “Enterprises heavily dependent on US exports are at serious risk. If exports to the US are disrupted, everyone will flock to alternative markets. This situation will make the alternative markets highly competitive. Exporters won’t receive fair prices.”

Other sectors also under threat

Aside from garments, Bangladesh exports footwear, headgear, tents, bags, furniture, and food products to the US. Of the exporting companies, 176 were entirely dependent on the US market last fiscal year. Among 703 exporters, 319 companies sent more than 50 per cent of their goods exclusively to the US.

Masud Agro Processing Food Products Ltd., located in Karnaphuli, Chattogram, is one such company. Its managing director Ashraf Hossain said, “We’ve been exporting frozen food and other items to the US for 13 years. When reciprocal tariffs were first announced three months ago, our US buyers temporarily suspended orders. Now, Trump’s latest declaration has reignited that uncertainty.”

Bangladesh’s exports to the US had been steadily increasing in recent years. Economists and researchers now warn that reciprocal tariffs could halt that momentum.

However, they also emphasised that there is still room for negotiation. If Bangladesh can engage in effective diplomacy and reduce the additional tariffs, especially in comparison to competitor countries, it may not only preserve but also expand its presence in the US market.

On the other hand, they maintained, if Bangladeshi products continue to face higher tariffs than those from rival exporters, the country could gradually lose access to the US market. This may have far-reaching implications for the national economy.

Bangladesh’s 801 export-oriented enterprises at high risk

Masud MiladChattogram

Published: 09 Jul 2025, 12: 27

Containers at Chittagong Port Prothom Alo file photo

More than 800 Bangladeshi export-oriented enterprises may face a significant amount of risk following the United States’ announcement of reciprocal tariffs on goods produced in Bangladesh. Exporters warn that unless the additional tariffs are negotiated and reduced, exports to the US could face serious setbacks.

US President Donald Trump on Monday announced a 35 per cent reciprocal tariff on Bangladeshi goods, which is set to come into effect from 1 August. This declaration has sparked concern among more than 2,000 Bangladeshi exporters with active trade links to the US.

Many of those firms also export to other countries. However, a number of them rely solely on the US market for their shipments.

An analysis of data from the National Board of Revenue (NBR) reveals that as many as 2,377 companies exported 1-100 per cent of their products to the US during the 2024–25 fiscal year. Among them, 801 companies sent more than 50 per cent of their total exports to the US, making them particularly vulnerable due to their overreliance on a single market.

Collectively, those 801 companies exported USD 6.62 billion (662 crore) worth of goods globally last fiscal year. Of which USD 5.05 billion (505 crore), or 58 per cent, of Bangladesh’s total exports went to the US.

Bangladeshi goods are already subject to tariffs 10–15 per cent higher than those from competing countries. This effectively means we are going to lose the US market. Buyers from the US are also already worried.

Mohammad Abdus Salam, managing director of Chattogram-based Asian & DAF Group

In total, Bangladesh exported goods worth USD 8.76 billion (876 crore) to the United States in the last fiscal year, including USD 7.59 billion (759 crore) in ready-made garments alone.

Garment sector faces the greatest threat

Chattogram-based Fortune Apparels, located in Nasirabad, exported garments worth USD 33.7 million (3.37 crore) last fiscal year, all of that was to the United States. Fortune Apparels is a sister concern of the Asian & DAF Group.

Speaking to Prothom Alo, Mohammad Abdus Salam, managing director of the group, said Bangladeshi goods are already subject to tariffs 10–15 per cent higher than those from competing countries. This effectively means we are going to lose the US market. Buyers from the US are also already worried. “If the tariffs aren’t reduced, they will move their sourcing elsewhere.”

Fortune Apparels is one of 168 companies that export exclusively to the US. If the new tariff takes effect, these firms could face existential threats, industry leaders warn.

Even companies that export the majority of their products to the US are also in a precarious position. One such firm is Independent Apparels, also based in Nasirabad of Chattogram. In the last fiscal year, 89 per cent of its exports were destined for the US.

Aside from garments, Bangladesh exports footwear, headgear, tents, bags, furniture, and food products to the US. Of the exporting companies, 176 were entirely dependent on the US market last fiscal year.

Speaking about this, Independent Apparels Ltd. managing director SM Abu Tayeb said, “We’ve been working with US buyers for nearly three decades. Retail giants like Walmart have put their trust in us. But if we must pay an additional 35 per cent on top of the existing 15 per cent tariff, totalling 50 per cent, then US buyers will no longer be interested in sourcing from Bangladesh. We’re looking to the 9 July bilateral meeting with the US (for a solution).”

BGMEA (Bangladesh Garment Manufacturers and Exporters Association) first vice-president Selim Rahman observed that there could be risks in the alternative markets to the US.

He noted, “Enterprises heavily dependent on US exports are at serious risk. If exports to the US are disrupted, everyone will flock to alternative markets. This situation will make the alternative markets highly competitive. Exporters won’t receive fair prices.”

Other sectors also under threat

Aside from garments, Bangladesh exports footwear, headgear, tents, bags, furniture, and food products to the US. Of the exporting companies, 176 were entirely dependent on the US market last fiscal year. Among 703 exporters, 319 companies sent more than 50 per cent of their goods exclusively to the US.

Masud Agro Processing Food Products Ltd., located in Karnaphuli, Chattogram, is one such company. Its managing director Ashraf Hossain said, “We’ve been exporting frozen food and other items to the US for 13 years. When reciprocal tariffs were first announced three months ago, our US buyers temporarily suspended orders. Now, Trump’s latest declaration has reignited that uncertainty.”

Bangladesh’s exports to the US had been steadily increasing in recent years. Economists and researchers now warn that reciprocal tariffs could halt that momentum.

However, they also emphasised that there is still room for negotiation. If Bangladesh can engage in effective diplomacy and reduce the additional tariffs, especially in comparison to competitor countries, it may not only preserve but also expand its presence in the US market.

On the other hand, they maintained, if Bangladeshi products continue to face higher tariffs than those from rival exporters, the country could gradually lose access to the US market. This may have far-reaching implications for the national economy.