- 3,026

- 1,501

- Copy to clipboard

- Moderator

- #1

Date of Event:

Dec 26, 2024

Craftsman Footwear targets $100m exports in next 5 years

Craftsman Footwear and Accessories Ltd, an export-oriented shoe manufacturer, has set a target to export shoes worth $100 million by the next five years.

To achieve the goal, the company plans to introduce a double shift at its factory in Gazipur by next year. Currently, it operates three production lines, with the manufacturing of 4,500 pairs of shoes in a single shift daily.

"We want to export $100 million worth of shoes by the next five years," Craftsman's Managing Director Sadat Hossain Salim told The Business Standard.

The company has shipped $7 million worth of shoes in fiscal 2021-22, and has set an export target of around $10 million in the current fiscal year.

Salim added, "Initially, we want to introduce a double shift by the next year to increase the capacity. In addition, we have an expansion plan to build a green building to achieve our goals."

He further said that Craftsman intends to enter the capital market in the SME platform by raising Tk50 million from the public.

"We want to realise the fund from the market through offloading five million shares of Tk10, which will be spent on the company's modernisation, expansion, and bank loan repayment."

The company aims to raise the export volume sufficiently in the next two to three years. For this, it intends to construct new production buildings and separate warehouses.

"We owe a sizable sum to the bank as well. Furthermore, interest rates have lately increased at banks as well. Thus, we wish to arrange capital from the stock market," said Salim.

He mentioned that an application has already been submitted to the Bangladesh Securities and Exchange Commission (BSEC) for enrollment of Craftsman in the SME board, and Green Delta Capital Ltd is acting as the issue manager to bring the company to the capital market.

The journey of Craftsman

In 2017, the Craftsman started operation as a shoe manufacturer for the export market with 35 employees at a small factory unit in Joina Bazar of Sreepur Upazila in Gazipur.

Now, the company has a state-of-the-art manufacturing facility with a 1,00,000-square-foot factory with over 750 manpower.

Sadat Hossain Salim has been inspired to invest in the footwear industry from his professional experiences. Previously he served at several domestic and international companies, including Apex, Partex Group, HRC Group, Duncan Brothers.

Salim mentioned that skilled designers at the Craftsman factory produce a diverse range of shoes that adhere to global standards. The production unit has cutting-edge machinery from Italy and Germany, along with some technological support brought from China.

Shoes such as pami, formal, casual, oxford, moccasin, derby, and high heels are among the productions of the company.

Craftsman Footwear has already received two ISO certifications for product quality and factory environment. It also has C-TPAT and Amfori certifications, said the managing director.

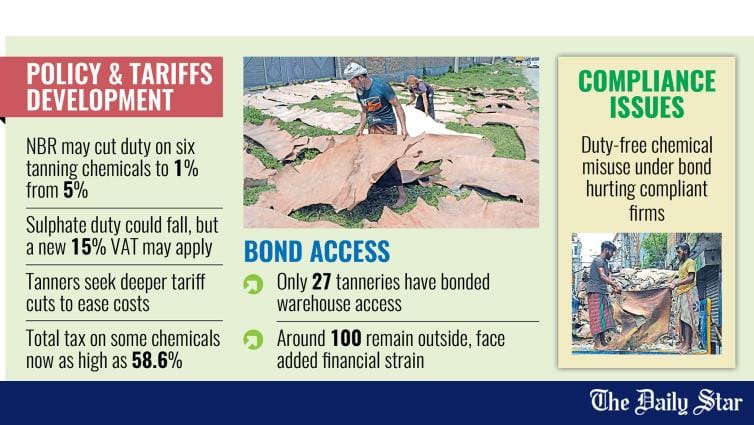

He added that the company imports leather from some compliant tanneries in Asia to maintain compliance in shoe manufacturing.

However, some leathers are sourced by Craftsman from the Chattogram-based tannery Reef Leather, which has the worldwide Leather Working Group (LWG) certification.

"Though our nation is a significant supplier of raw hides, we are losing to China, Pakistan, and India in the competitive market because we do not have LWG-certified leather producers," said Salim.

Craftsman caters to local market too

Craftsman Shoes has already introduced its brand name in the local market and ensured its presence in the online space as well.

Shoes for local sales are produced at a separate unit of the company.

"We have a plan to set up a physical store for local customers," said Salim.

Around 80% of the shoes available in the country are made of synthetic or artificial leather, he said, mentioning, "There is a huge potential for manufacturing of leather shoes and products in the country."