Saif

Senior Member

- Messages

- 14,826

- Reaction score

- 7,689

- Origin

- Residence

- Axis Group

Compliance issues get in way of fully tapping leather export potential: Labour secretary

Bangladesh has yet to fully harness the potential of its leather goods exports mainly because of compliance issues, Labour and Employment Secretary AHM Shafiquzzaman has said. Leather can be a good item that can help reduce the country’s high dependency on one item—readymade garment, w

Compliance issues get in way of fully tapping leather export potential: Labour secretary

FE ONLINE REPORT

Published :

Sep 26, 2024 20:29

Updated :

Sep 26, 2024 21:42

Share this news

Bangladesh has yet to fully harness the potential of its leather goods exports mainly because of compliance issues, Labour and Employment Secretary AHM Shafiquzzaman has said.

Leather can be a good item that can help reduce the country’s high dependency on one item—readymade garment, which contributes more than 82 per cent of Bangladesh’s total export earnings, he said, adding that value addition to leather goods is 97 per cent while most of the raw materials used in garment-producing are imported, including cotton.

The secretary hoped that a checklist would help address compliance issues in line with buyer requirements.

The programme was organised by ‘Good Working Conditions in Tanneries (GOTAIN)’ project of German-based Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ).

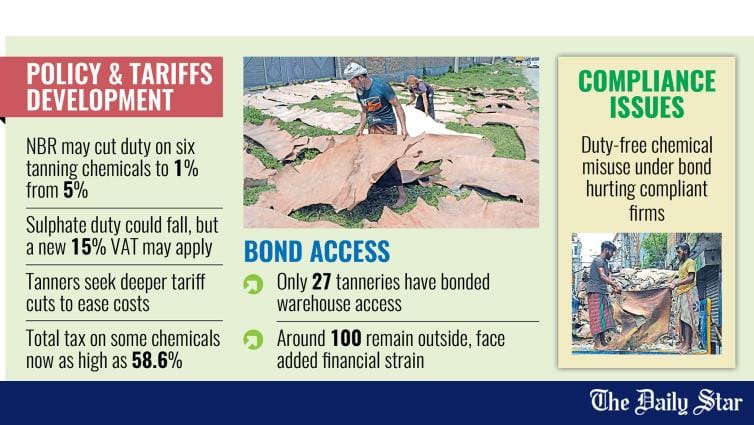

During the workshop, it was revealed that most of the leather product exporters in Bangladesh have failed to obtain Leather Working Group (LWG) certification, an internationally recognised standard, due to the industry's inability to meet environmental and social compliance requirements.

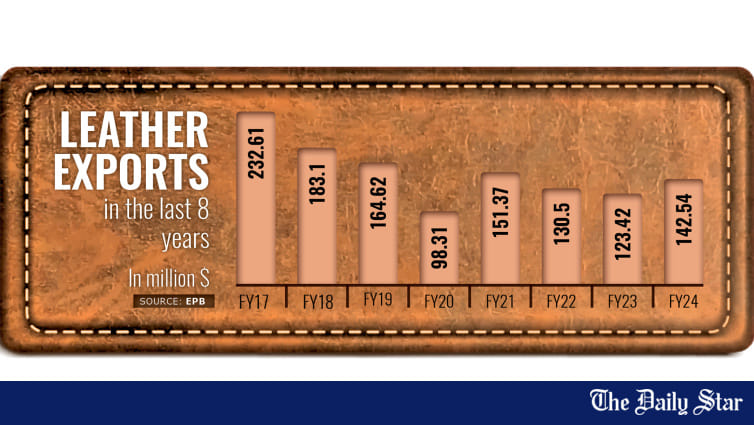

As a result, many of Bangladesh's factories are unable to directly export leather products to markets like the European Union and America, which industry leaders believe is contributing to the decline in export earnings.

Although there was initial optimism that relocating tanneries from Hazaribagh to Savar, would improve conditions, industry leaders noted that the situation has not improved. The Central Effluent Treatment Plant (CETP) is still not fully operational, and leather waste continues to pollute local rivers, posing environmental risks.

Matiur Rahaman joint inspector general at Department of Inspection for Factories and Establishments (DIFE) and project director of GOTAN and Alina Moser advisor GOTAN, GIZ Bangladesh made two separate presentations on checklist and status quo of the developments of the tannery sector in Bangladesh respectively.

DIFE Inspector General Abdur Rahim Khan, Additional Inspector General Arif Ahmed Khan, and head of GOTAN project Md Firoz Alam, among others, spoke at the programme.

FE ONLINE REPORT

Published :

Sep 26, 2024 20:29

Updated :

Sep 26, 2024 21:42

Share this news

Bangladesh has yet to fully harness the potential of its leather goods exports mainly because of compliance issues, Labour and Employment Secretary AHM Shafiquzzaman has said.

Leather can be a good item that can help reduce the country’s high dependency on one item—readymade garment, which contributes more than 82 per cent of Bangladesh’s total export earnings, he said, adding that value addition to leather goods is 97 per cent while most of the raw materials used in garment-producing are imported, including cotton.

The secretary hoped that a checklist would help address compliance issues in line with buyer requirements.

The programme was organised by ‘Good Working Conditions in Tanneries (GOTAIN)’ project of German-based Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ).

During the workshop, it was revealed that most of the leather product exporters in Bangladesh have failed to obtain Leather Working Group (LWG) certification, an internationally recognised standard, due to the industry's inability to meet environmental and social compliance requirements.

As a result, many of Bangladesh's factories are unable to directly export leather products to markets like the European Union and America, which industry leaders believe is contributing to the decline in export earnings.

Although there was initial optimism that relocating tanneries from Hazaribagh to Savar, would improve conditions, industry leaders noted that the situation has not improved. The Central Effluent Treatment Plant (CETP) is still not fully operational, and leather waste continues to pollute local rivers, posing environmental risks.

Matiur Rahaman joint inspector general at Department of Inspection for Factories and Establishments (DIFE) and project director of GOTAN and Alina Moser advisor GOTAN, GIZ Bangladesh made two separate presentations on checklist and status quo of the developments of the tannery sector in Bangladesh respectively.

DIFE Inspector General Abdur Rahim Khan, Additional Inspector General Arif Ahmed Khan, and head of GOTAN project Md Firoz Alam, among others, spoke at the programme.