- Copy to clipboard

- Thread starter

- #91

Saif

Senior Member

- Jan 24, 2024

- 11,686

- 6,563

- Origin

- Residence

- Axis Group

How we are missing out on higher remittances

Do we have the vision and political will to accelerate change and make the most of the opportunities that are about to unfold?

How we are missing out on higher remittances

VISUAL: NAZIFA RAIDAH

Migrant workers from Bangladesh are disadvantaged in many ways compared to their counterparts from other countries. To cite one disadvantage: as per a February report by The Business Standard, an aspiring Bangladeshi migrant worker bound for Malaysia pays between $4,000 and $4,500 for employment in the manufacturing or construction industries. But for the same opportunities, Indonesian workers pay between $340 and $742. This is despite the Bangladesh government setting a maximum Tk 78,990 (less than $1,000) migration cost for workers travelling to Malaysia. The cost of migration is equally exorbitant for Bangladeshi workers travelling to other countries in search of livelihood. In fact, a 2020 International Organization for Migration (IOM) report suggested that the migration cost of Bangladeshi workers is considered one of the highest in the world.

This is attributed mostly to the corruption in the system that has enabled syndicates to be formed among recruitment agencies, in addition to ineffective migration diplomacy, and limited efforts from the concerned authorities to ensure the wellbeing and rights of the migrant workers.

While the remittances sent by the migrant workers are valued highly, we have not taken effective measures over the years to map international market demand for skilled labour and accordingly upskill aspiring migrant workers, which would have translated into higher remittance for us.

we must understand that in a fast-changing landscape, where quality of work is becoming increasingly important for employers, new avenues are opening up for the skilled workforce. So, being content with pushing more unskilled workers into the global labour market is no longer an option.

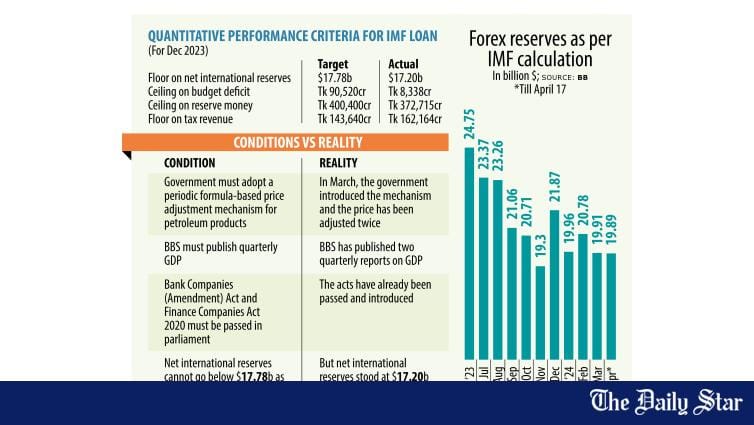

Even at a time when our volatile forex reserve remains a major economic concern and despite the growth in the number of migrant workers—around 1.3 million workers migrated abroad in 2023, a 15 percent increase from 1.13 million in 2022, thanks to Saudi and Malaysian markets opening up—we have not been able to tap the full potential of the expanding job market abroad, both in terms of revenue volume and skilled worker migration.

The remittance inflow in 2023 remained stagnant at the $21 billion mark, despite more workers migrating abroad. In 2022, remittance inflow was $21.28 billion and in 2021 it stood at $21.74 billion. Given the 15 percent year-on-year increase in worker migration in 2023, the mere 2.54 percent year-on-year increase in remittance in 2023 is a telling tale of wasted opportunities and the inability of formal banking channels to woo customers.

A study of government data by the Refugee and Migratory Movements Research Unit (RMMRU) revealed that of the workers who migrated in 2022, a staggering 78.64 percent were less skilled. In 2021, it stood at 75.24 percent. While there was some improvement in 2023, with an increased number of skilled and semi-skilled worker migration, less skilled workers still made up more than half of the entire pie, at 50.28 percent, according to the Bureau of Manpower, Employment and Training (BMET).

This is mostly due to our lack of demand mapping, planning, and political will to tap into the skilled labour market. Bangladesh has always eyed the less skilled market with its lower barrier to entry, entertaining demand from traditional markets needing low-paid unskilled, less skilled workers. But we must understand that in a fast-changing landscape, where quality of work is becoming increasingly important for employers, new avenues are opening up for the skilled workforce. So, being content with pushing more unskilled workers into the global labour market is no longer an option.

Our Asian peers are quickly upskilling their workforce to capture the new markets and their workers are earning higher wages, while in Bangladesh, we are patting ourselves on the back for sending about 1.3 million workers abroad, without a plan on how to tap into the new markets and enable our workers to find better-paying jobs, in turn us getting higher remittance.

We must study the global labour market patterns to identify new destinations for Bangladeshi workers, and the skill sets required to make sure our workers succeed there. Better coordination, cooperation, and oversight among the government and private sector actors are critical to improving the living conditions of our workforce abroad and driving forex earnings.

However, for this to happen, we would need to overhaul our overseas employment system which is lethargic by nature and mired in corruption. There is no way that notorious syndicates are given free reign to do as they wish—exploiting unsuspecting and powerless migrant workers—without the system benefitting from their illegal gains.

The transformative push in the labour migration landscape of our country would also mean that the Bangladeshi missions abroad would have to make efforts to identify potential industries for foreign worker recruitment in the countries where they are located and the skills that would be required to fill those requirements. The concerned officials would have to engage in robust migration diplomacy to negotiate good deals for our workers—both in terms of wages and living conditions.

It is true that in Bangladesh we lack adequate technical training centres and polytechnic institutes. So the focus should be on building additional capabilities while fully utilising the existing facilities.

It is high time the government came out of its complacency mindset and transformed the overseas employment sector to make the most of the new opportunities opening up for Bangladesh. While demand for unskilled and less skilled workers will sustain in the traditional markets for some more years, if we do not compete for the new markets in need of a semi-skilled and skilled workforce, our Asian peers will win them over, leaving us little room to manoeuvre.

Do we have the vision and political will to accelerate change and make the most of the opportunities that are about to unfold?

Tasneem Tayeb is a columnist for The Daily Star.

VISUAL: NAZIFA RAIDAH

Migrant workers from Bangladesh are disadvantaged in many ways compared to their counterparts from other countries. To cite one disadvantage: as per a February report by The Business Standard, an aspiring Bangladeshi migrant worker bound for Malaysia pays between $4,000 and $4,500 for employment in the manufacturing or construction industries. But for the same opportunities, Indonesian workers pay between $340 and $742. This is despite the Bangladesh government setting a maximum Tk 78,990 (less than $1,000) migration cost for workers travelling to Malaysia. The cost of migration is equally exorbitant for Bangladeshi workers travelling to other countries in search of livelihood. In fact, a 2020 International Organization for Migration (IOM) report suggested that the migration cost of Bangladeshi workers is considered one of the highest in the world.

This is attributed mostly to the corruption in the system that has enabled syndicates to be formed among recruitment agencies, in addition to ineffective migration diplomacy, and limited efforts from the concerned authorities to ensure the wellbeing and rights of the migrant workers.

While the remittances sent by the migrant workers are valued highly, we have not taken effective measures over the years to map international market demand for skilled labour and accordingly upskill aspiring migrant workers, which would have translated into higher remittance for us.

we must understand that in a fast-changing landscape, where quality of work is becoming increasingly important for employers, new avenues are opening up for the skilled workforce. So, being content with pushing more unskilled workers into the global labour market is no longer an option.

Even at a time when our volatile forex reserve remains a major economic concern and despite the growth in the number of migrant workers—around 1.3 million workers migrated abroad in 2023, a 15 percent increase from 1.13 million in 2022, thanks to Saudi and Malaysian markets opening up—we have not been able to tap the full potential of the expanding job market abroad, both in terms of revenue volume and skilled worker migration.

The remittance inflow in 2023 remained stagnant at the $21 billion mark, despite more workers migrating abroad. In 2022, remittance inflow was $21.28 billion and in 2021 it stood at $21.74 billion. Given the 15 percent year-on-year increase in worker migration in 2023, the mere 2.54 percent year-on-year increase in remittance in 2023 is a telling tale of wasted opportunities and the inability of formal banking channels to woo customers.

A study of government data by the Refugee and Migratory Movements Research Unit (RMMRU) revealed that of the workers who migrated in 2022, a staggering 78.64 percent were less skilled. In 2021, it stood at 75.24 percent. While there was some improvement in 2023, with an increased number of skilled and semi-skilled worker migration, less skilled workers still made up more than half of the entire pie, at 50.28 percent, according to the Bureau of Manpower, Employment and Training (BMET).

This is mostly due to our lack of demand mapping, planning, and political will to tap into the skilled labour market. Bangladesh has always eyed the less skilled market with its lower barrier to entry, entertaining demand from traditional markets needing low-paid unskilled, less skilled workers. But we must understand that in a fast-changing landscape, where quality of work is becoming increasingly important for employers, new avenues are opening up for the skilled workforce. So, being content with pushing more unskilled workers into the global labour market is no longer an option.

Our Asian peers are quickly upskilling their workforce to capture the new markets and their workers are earning higher wages, while in Bangladesh, we are patting ourselves on the back for sending about 1.3 million workers abroad, without a plan on how to tap into the new markets and enable our workers to find better-paying jobs, in turn us getting higher remittance.

We must study the global labour market patterns to identify new destinations for Bangladeshi workers, and the skill sets required to make sure our workers succeed there. Better coordination, cooperation, and oversight among the government and private sector actors are critical to improving the living conditions of our workforce abroad and driving forex earnings.

However, for this to happen, we would need to overhaul our overseas employment system which is lethargic by nature and mired in corruption. There is no way that notorious syndicates are given free reign to do as they wish—exploiting unsuspecting and powerless migrant workers—without the system benefitting from their illegal gains.

The transformative push in the labour migration landscape of our country would also mean that the Bangladeshi missions abroad would have to make efforts to identify potential industries for foreign worker recruitment in the countries where they are located and the skills that would be required to fill those requirements. The concerned officials would have to engage in robust migration diplomacy to negotiate good deals for our workers—both in terms of wages and living conditions.

It is true that in Bangladesh we lack adequate technical training centres and polytechnic institutes. So the focus should be on building additional capabilities while fully utilising the existing facilities.

It is high time the government came out of its complacency mindset and transformed the overseas employment sector to make the most of the new opportunities opening up for Bangladesh. While demand for unskilled and less skilled workers will sustain in the traditional markets for some more years, if we do not compete for the new markets in need of a semi-skilled and skilled workforce, our Asian peers will win them over, leaving us little room to manoeuvre.

Do we have the vision and political will to accelerate change and make the most of the opportunities that are about to unfold?

Tasneem Tayeb is a columnist for The Daily Star.