Saif

Senior Operative

- 13,251

- 7,269

- Origin

- Axis Group

- Copy to clipboard

- Thread starter

- #129

Uneven competition with banks hinders NBFIs’ growth

The country as a whole is going through one of the most difficult periods, created by the previous authoritarian regime through corruption and money laundering and it has left a deep scar on Bangladesh’s overall economy and financial system...

www.newagebd.net

www.newagebd.net

Uneven competition with banks hinders NBFIs’ growth

Mostafizur Rahman 23 February, 2025, 23:21

Humaira Azam

The country as a whole is going through one of the most difficult periods, created by the previous authoritarian regime through corruption and money laundering and it has left a deep scar on Bangladesh’s overall economy and financial system.

As a result, all financial institutions are facing significant challenges in securing funds and procuring new business due to unfair competition with a few banks, market distortions, and governance issues, making it difficult for the majority of banks and financial institutions to operate effectively, said Humaira Azam, Managing Director of LankaBangla Finance PLC.

In an interview with New Age Business magazine, she highlighted the critical issues affecting most NBFIs and banks, including an uneven playing field in deposit collection, reliance on high-cost borrowing from banks, and broader governance failures that have eroded public trust in the financial system.

Some large banks have sought liquidity support from Bangladesh Bank in the face of a deposit run.

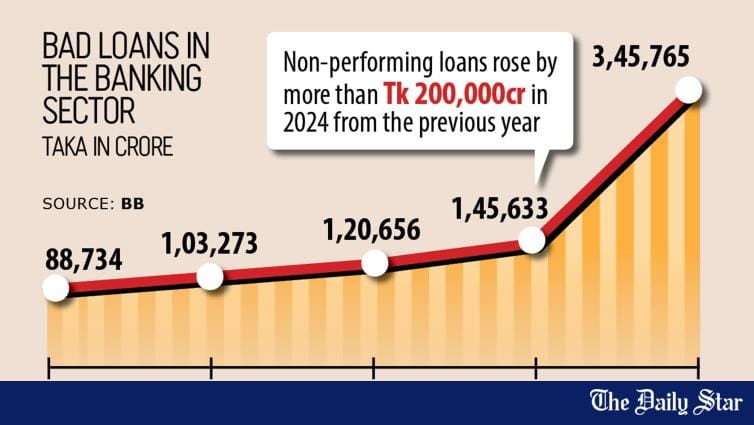

Additionally, the non-performing loan (NPL) situation has further weakened the overall financial system, particularly affecting several banks and NBFIs.

NBFIs and banks compete for the same pool of long-term deposits, which serve as the primary funding source for NBFIs.

However, banks hold a significant advantage due to their access to current and savings accounts (CASA), enabling them to offer higher deposit rates without increasing their overall funding costs. This creates a market distortion, making it nearly impossible for NBFIs to raise funds at competitive rates.

As a result of these imbalances, banks attract the best borrowers, while NBFIs are left with riskier clients and lower-quality assets, increasing their exposure to defaults.

Humaira Azam, a career banker who previously served as Managing Director of a private commercial bank, stressed the need for a cap on deposit rates for banks to ensure fair competition and enable NBFIs to compete effectively.

Without such measures, NBFIs are at a disadvantage, particularly as they often have to borrow from banks at high interest rates to sustain their operations—not to mention the mismatch between tenors.

‘NBFIs are treated like any other corporate borrower by banks, which weakens their ability to function effectively,’ she said.

In Bangladesh, the financial sector is overcrowded, with 62 banks and 35 NBFIs competing for the same resources.

This has led to a shortage of qualified professionals, further destabilising the sector. Many NBFIs and banks are struggling to survive and failing to repay depositors, which damages public confidence.

She pointed out that mergers and liquidations are necessary for the sector’s stability. Consolidation would allow well-managed institutions to survive while reducing the risks posed by failing financial institutions. Such steps are crucial for restoring depositors’ trust in the financial sector.

She also underscored the difficulties NBFIs face in raising funds due to the underdeveloped capital market and the absence of a functional secondary market, as one of the primary conditions for funding NBFIs is a long-term bond.

The lack of a robust bond market has made capital collection extremely challenging.

Even large corporations and banks struggle to raise money through bonds, and NBFIs face an even greater disadvantage.

The government dominates the bond market, borrowing at high rates, which raises the benchmarks for all borrowers. This, in turn, increases the cost of capital for private-sector entities, including NBFIs.

‘We also note that Bangladesh Bank has recently been taking steps to reduce rates for government instruments (bills and bonds). This is expected to improve the overall scenario,’ she said.

Regarding the rise in defaulted loans in the industry, she attributed the issue to money laundering by some common borrowers in the industry, as well as some fleeing the country due to their political affiliations.

‘We have identified some borrowers as wilful defaulters and are actively working to hold them accountable,’ she said.

She emphasised that LankaBangla is now prioritising loan recovery, ensuring that even influential defaulters will not be exempt from action.

Another major concern is the governance crisis in financial institutions. Poor oversight and systemic corruption have significantly weakened the sector.

She noted that wilful defaulters continue to exploit both banks and NBFIs. Even globally ranked, well-performing banks have been hijacked by a few individuals, destabilising the entire financial system.

The banking and financial sector in Bangladesh has suffered from multiple financial scams, including Ponzi schemes, multi-level marketing fraud, and e-commerce collapses. These events have eroded public trust, making depositors hesitant to place their money even in strong financial institutions, despite them never having sought liquidity support.

To restore stability, she called for comprehensive reforms, including stricter regulations, enhanced oversight, and greater accountability, which Bangladesh Bank is currently strengthening. Without decisive action, financial institutions will continue to struggle, and public confidence will remain low.

Humaira Azam

She also pointed out a severe shortage of qualified professionals in the sector. Banks and NBFIs require highly skilled financial experts, especially for handling long-term projects that involve complex financial assessments.

However, many professionals, including finance graduates and MBAs, avoid NBFIs due to lower pay and fewer career incentives.

NBFIs face greater challenges than banks, yet their earnings are limited, making it difficult to offer competitive salaries. Without a more attractive pay structure, it will be hard to attract the right talent to strengthen the sector.

Regulators are now reassessing the sector and taking a proactive role in ensuring liquidity support for NBFIs, similar to the measures in place for banks.

A special committee should be formed to devise long-term planning strategies to address the sector’s liquidity and governance challenges, she said.

According to the senior banker, poor corporate governance has been a key factor in the struggles of many banks and NBFIs. While some institutions have remained strong under clean and professional boards, many others have suffered due to corruption at the top, she said.

In many cases, directors have treated financial institutions as their own businesses, leading to reckless decision-making and financial mismanagement.

Where boards remained clean, the institutions performed well. However, in cases where management was given too much unchecked freedom, trust was often breached, she said.

She emphasised that transparency in the financial sector is still lacking, but steps can be taken to rebuild confidence.

A critical issue that requires immediate attention is the asset cover of borrowers. Many businesses have grown substantially, but their collateral has not increased proportionately, she said.

This puts lenders at risk, particularly during economic downturns. In light of global crises, such as commodity price fluctuations and economic instability, NBFIs must reassess asset cover requirements to ensure financial stability.

Currency volatility is another major concern. Sharp fluctuations in exchange rates can disrupt both working capital and long-term loan repayments, increasing the likelihood of defaults where there is dependency on imports.

While loan contracts typically include clauses addressing currency risks, extreme economic conditions—such as those seen in Bangladesh and Sri Lanka—can override these agreements, causing severe financial disruptions.

Economic downturns can significantly impact a borrower’s ability to repay loans, potentially leading to widespread defaults unless lenders provide temporary relief.

If capital machinery has already been imported and a borrower has exhausted their equity, financial inflexibility can cripple even large-scale projects. This calls for a more adaptive approach to risk management.

She urged regulators and policymakers to take immediate steps to address these challenges and implement long-term solutions. ‘Without structural reforms and stronger governance, the financial sector will remain vulnerable to crises, and public trust will continue to erode,’ she said.

Mostafizur Rahman 23 February, 2025, 23:21

Humaira Azam

The country as a whole is going through one of the most difficult periods, created by the previous authoritarian regime through corruption and money laundering and it has left a deep scar on Bangladesh’s overall economy and financial system.

As a result, all financial institutions are facing significant challenges in securing funds and procuring new business due to unfair competition with a few banks, market distortions, and governance issues, making it difficult for the majority of banks and financial institutions to operate effectively, said Humaira Azam, Managing Director of LankaBangla Finance PLC.

In an interview with New Age Business magazine, she highlighted the critical issues affecting most NBFIs and banks, including an uneven playing field in deposit collection, reliance on high-cost borrowing from banks, and broader governance failures that have eroded public trust in the financial system.

Some large banks have sought liquidity support from Bangladesh Bank in the face of a deposit run.

Additionally, the non-performing loan (NPL) situation has further weakened the overall financial system, particularly affecting several banks and NBFIs.

NBFIs and banks compete for the same pool of long-term deposits, which serve as the primary funding source for NBFIs.

However, banks hold a significant advantage due to their access to current and savings accounts (CASA), enabling them to offer higher deposit rates without increasing their overall funding costs. This creates a market distortion, making it nearly impossible for NBFIs to raise funds at competitive rates.

As a result of these imbalances, banks attract the best borrowers, while NBFIs are left with riskier clients and lower-quality assets, increasing their exposure to defaults.

Humaira Azam, a career banker who previously served as Managing Director of a private commercial bank, stressed the need for a cap on deposit rates for banks to ensure fair competition and enable NBFIs to compete effectively.

Without such measures, NBFIs are at a disadvantage, particularly as they often have to borrow from banks at high interest rates to sustain their operations—not to mention the mismatch between tenors.

‘NBFIs are treated like any other corporate borrower by banks, which weakens their ability to function effectively,’ she said.

In Bangladesh, the financial sector is overcrowded, with 62 banks and 35 NBFIs competing for the same resources.

This has led to a shortage of qualified professionals, further destabilising the sector. Many NBFIs and banks are struggling to survive and failing to repay depositors, which damages public confidence.

She pointed out that mergers and liquidations are necessary for the sector’s stability. Consolidation would allow well-managed institutions to survive while reducing the risks posed by failing financial institutions. Such steps are crucial for restoring depositors’ trust in the financial sector.

She also underscored the difficulties NBFIs face in raising funds due to the underdeveloped capital market and the absence of a functional secondary market, as one of the primary conditions for funding NBFIs is a long-term bond.

The lack of a robust bond market has made capital collection extremely challenging.

Even large corporations and banks struggle to raise money through bonds, and NBFIs face an even greater disadvantage.

The government dominates the bond market, borrowing at high rates, which raises the benchmarks for all borrowers. This, in turn, increases the cost of capital for private-sector entities, including NBFIs.

‘We also note that Bangladesh Bank has recently been taking steps to reduce rates for government instruments (bills and bonds). This is expected to improve the overall scenario,’ she said.

Regarding the rise in defaulted loans in the industry, she attributed the issue to money laundering by some common borrowers in the industry, as well as some fleeing the country due to their political affiliations.

‘We have identified some borrowers as wilful defaulters and are actively working to hold them accountable,’ she said.

She emphasised that LankaBangla is now prioritising loan recovery, ensuring that even influential defaulters will not be exempt from action.

Another major concern is the governance crisis in financial institutions. Poor oversight and systemic corruption have significantly weakened the sector.

She noted that wilful defaulters continue to exploit both banks and NBFIs. Even globally ranked, well-performing banks have been hijacked by a few individuals, destabilising the entire financial system.

The banking and financial sector in Bangladesh has suffered from multiple financial scams, including Ponzi schemes, multi-level marketing fraud, and e-commerce collapses. These events have eroded public trust, making depositors hesitant to place their money even in strong financial institutions, despite them never having sought liquidity support.

To restore stability, she called for comprehensive reforms, including stricter regulations, enhanced oversight, and greater accountability, which Bangladesh Bank is currently strengthening. Without decisive action, financial institutions will continue to struggle, and public confidence will remain low.

Humaira Azam

She also pointed out a severe shortage of qualified professionals in the sector. Banks and NBFIs require highly skilled financial experts, especially for handling long-term projects that involve complex financial assessments.

However, many professionals, including finance graduates and MBAs, avoid NBFIs due to lower pay and fewer career incentives.

NBFIs face greater challenges than banks, yet their earnings are limited, making it difficult to offer competitive salaries. Without a more attractive pay structure, it will be hard to attract the right talent to strengthen the sector.

Regulators are now reassessing the sector and taking a proactive role in ensuring liquidity support for NBFIs, similar to the measures in place for banks.

A special committee should be formed to devise long-term planning strategies to address the sector’s liquidity and governance challenges, she said.

According to the senior banker, poor corporate governance has been a key factor in the struggles of many banks and NBFIs. While some institutions have remained strong under clean and professional boards, many others have suffered due to corruption at the top, she said.

In many cases, directors have treated financial institutions as their own businesses, leading to reckless decision-making and financial mismanagement.

Where boards remained clean, the institutions performed well. However, in cases where management was given too much unchecked freedom, trust was often breached, she said.

She emphasised that transparency in the financial sector is still lacking, but steps can be taken to rebuild confidence.

A critical issue that requires immediate attention is the asset cover of borrowers. Many businesses have grown substantially, but their collateral has not increased proportionately, she said.

This puts lenders at risk, particularly during economic downturns. In light of global crises, such as commodity price fluctuations and economic instability, NBFIs must reassess asset cover requirements to ensure financial stability.

Currency volatility is another major concern. Sharp fluctuations in exchange rates can disrupt both working capital and long-term loan repayments, increasing the likelihood of defaults where there is dependency on imports.

While loan contracts typically include clauses addressing currency risks, extreme economic conditions—such as those seen in Bangladesh and Sri Lanka—can override these agreements, causing severe financial disruptions.

Economic downturns can significantly impact a borrower’s ability to repay loans, potentially leading to widespread defaults unless lenders provide temporary relief.

If capital machinery has already been imported and a borrower has exhausted their equity, financial inflexibility can cripple even large-scale projects. This calls for a more adaptive approach to risk management.

She urged regulators and policymakers to take immediate steps to address these challenges and implement long-term solutions. ‘Without structural reforms and stronger governance, the financial sector will remain vulnerable to crises, and public trust will continue to erode,’ she said.