From Promise to Prosperity

Getting FDI Right in Bangladesh

M G Quibria

Published :

Jun 24, 2025 00:58

Updated :

Jun 24, 2025 00:59

Foreign direct investment (FDI) has been a cornerstone of economic transformation in many developing countries. It brings not only capital but also global market access, cutting-edge technology, managerial know-how, and integration into international production networks. Countries like Vietnam and Mexico have harnessed FDI to build dynamic industrial bases, diversify exports, and sustain robust growth trajectories. An important feature of the FDI inflow into these two countries has been the type of FDI - the majority being platform FDI, an investment mainly geared to export to third countries. By contrast, Bangladesh's experience has been far more modest. Despite its notable gains, until recent reversals, the country has remained a peripheral player in the global FDI landscape in poverty reduction and macroeconomic stability. This failure is neither accidental nor inevitable. It reflects deep-rooted structural weaknesses, policy inertia, and strategic misalignments.

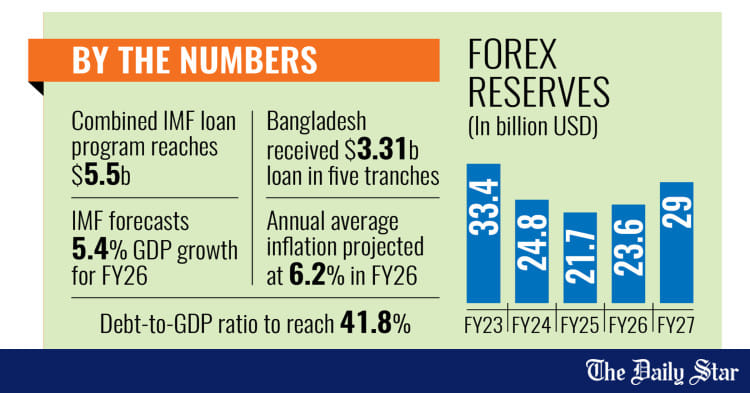

The numbers alone are stark. Bangladesh has attracted less than $3 billion in annual FDI inflows in recent years, amounting to under 1 per cent of gross domestic product (GDP). This places it well behind its successful peers. Vietnam draws around $20 billion annually, while Mexico receives between $35-40 billion, despite its proximity to the turbulent United States (US) political and trade environment. More troubling than the quantity is the quality of investment. In Bangladesh, although there has been a change in direction, FDI was traditionally channelled into non-tradable sectors such as telecommunications and energy. These sectors, while important, do not catalyze export growth, industrial upgrading, or widespread employment.

In contrast, Vietnam and Mexico have consistently drawn FDI into globally competitive, export-oriented sectors, including electronics, automotive, textiles, and, increasingly, high-tech industries such as semiconductors and aerospace. Some other Asian countries that successfully attract FDI are more import-substituting than export-promoting. India's Production-Linked Incentives (PLI) policy has positively incentivised FDI toward exports, yet its success has been, at best, limited.

Why has Bangladesh lagged so far behind? The answer lies in a combination of institutional, infrastructural, and human capital deficiencies, compounded by policy inconsistency and weak governance. While some reforms have been introduced recently, they remain piecemeal and often poorly implemented.

A key obstacle is the country's weak institutional framework for investment promotion. Although the Bangladesh Investment Development Authority (BIDA) was created to serve as a one-stop shop for investors, it remains burdened by slow, opaque, and often arbitrary administrative processes. Investors report long delays in project approvals, inconsistent regulatory enforcement, and difficulties in obtaining land and utility connections. The country's poor rankings in the now-discontinued World Bank Doing Business Index-particularly in contract enforcement, cross-border trade, and dealing with construction permits-underscore these challenges.

In contrast, Vietnam has taken a proactive, coordinated approach to investment facilitation. Special economic zones (SEZs) there are not mere geographic enclaves but fully integrated industrial ecosystems offering streamlined services, legal clarity, and infrastructure linkages. Mexico, too, provides a more mature investment regime bolstered by a relatively independent judiciary, clear rules for dispute resolution, and a deep network of bilateral investment treaties. These frameworks reduce uncertainty and reassure investors. Despite recent policy documents such as the FDI Heat map 2025 identifying priority sectors, Bangladesh has yet to develop a comprehensive, investor-friendly institutional architecture with teeth.

Infrastructure gaps pose another critical constraint. Bangladesh's logistics network remains underdeveloped, with congested ports, limited container-handling capacity, and unreliable power supplies. Transport connectivity between industrial hubs and ports is weak, raising costs and reducing competitiveness. Although the opening of the Padma Bridge has improved regional connectivity, broader infrastructure bottlenecks persist-hampering not only trade but also the movement of labour and capital.

Vietnam's ports are now among the most efficient in Southeast Asia, and the country's emphasis on physical infrastructure has dramatically reduced logistics costs. Due to its proximity to the United States, Mexico benefits from extensive highway and rail corridors that connect seamlessly with North American value chains. Bangladesh, lacking such locational advantages, must compensate through aggressive investment in transport, logistics, and energy infrastructure. Initiatives such as the Economic Zones (Amendment) Bill 2023 and new G2G industrial parks are promising -but their sluggish execution undermines their potential impact.

Compounding these physical bottlenecks are protectionist trade policies that discourage export-oriented investment. Bangladesh maintains high average tariff rates and a dense web of para-tariffs. While these may protect domestic firms in the short term, they deter foreign firms seeking to use Bangladesh as a base for regional or global exports. Moreover, the country has remained relatively isolated from regional and bilateral trade agreements. It is not a member of any major economic bloc comparable to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the Regional Comprehensive Economic Partnership (RCEP), which have been instrumental in driving FDI into Vietnam.

Mexico's membership in the USMCA (formerly NAFTA) has provided it with privileged access to the vast U.S. market, a magnet for global investors. For Bangladesh, the challenge is not just negotiating new trade agreements but undertaking the internal reforms-such as customs simplification, reduction of non-tariff barriers, and harmonisation of standards-required to benefit from them.

The country's labour market is another area of concern. Bangladesh often touts its large labour force as an asset, which hides a serious skills deficit. The education system, particularly technical and vocational training, is poorly aligned with labour market demands. Institutions remain underfunded, teachers under-qualified, and curricula outdated. As a result, even in labour-intensive sectors like garments, productivity remains low compared to peers. Foreign investors are often compelled to provide extensive on-the-job training or import higher-end skilled workers -both costly propositions that circumscribe Bangladesh's competitiveness.

Vietnam, by contrast, has made targeted investments in technical education, working closely with the private sector to design training programs. Mexico, too, has fostered a skilled workforce in niche areas such as automotive engineering and aerospace technology. For Bangladesh, the path forward requires a national skills strategy that integrates education, industry, and investment planning. Piecemeal projects will not suffice; a coordinated, adequately resourced push is needed.

Governance also looms large as a deterrent. Investors consistently cite concerns over regulatory unpredictability, legal opacity, and corruption. While Bangladesh has achieved some measure of macroeconomic stability-evident in moderate inflation and a growing GDP-it has not translated into a stable business environment. Political volatility, weak contract enforcement, and perceptions of favouritism erode investor confidence.

Efforts to liberalise the financial sector, such as the Offshore Banking Act of 2024, are steps in the right direction. However, without improvements in regulatory quality, judicial independence, and anti-corruption enforcement, these reforms are unlikely to alter perceptions in a meaningful way. In contrast, Vietnam offers a relatively predictable investment climate, and even Mexico, despite facing security challenges, provides legal protections under a network of international agreements that mitigate investor risks.

Another underappreciated factor is the lack of export diversification. Over 80 per cent of Bangladesh's exports come from ready-made garments (RMG), a sector that, while successful, is increasingly vulnerable to automation, environmental scrutiny, and shifting global demand. Vietnam and Mexico have diversified aggressively, attracting investment in high-tech sectors. Vietnam has become a manufacturing base for global electronics giants such as Samsung and Intel. Mexico, meanwhile, has emerged as a competitive hub for aerospace and automobile production. These countries offer not just low costs but ecosystems of suppliers, skilled labour, and logistics that reinforce FDI flows.

Bangladesh's efforts to emulate this model-such as the One-Stop Banking Service (2023) launched by BIDA and BRAC Bank-are helpful but far too limited in scope. It has been argued that a broader industrial policy framework is needed, one that actively supports the emergence of new export sectors through targeted infrastructure, tax incentives, and R&D support.

Geographic disadvantage is another oft-cited explanation for Bangladesh's FDI underperformance. The country is remote from major global markets and surrounded by challenging neighbours with whom it shares complicated political and logistical relationships. While there is an element of truth to this explanation, this truth is not immutable to time and effort. Vietnam, too, once suffered from isolation and conflict but overcame it through strategic investments in connectivity, openness to trade, and deep institutional reform. Bangladesh can follow a similar path-if it has the will.

Crucial to this transformation is a decisive commitment to education. Despite broad acknowledgment of its importance, the education sector remains chronically underfunded and politically manipulated. Public schools suffer from poor facilities, low teacher morale, and weak oversight. University curricula are often out of sync with market needs. Even more troubling is the politicisation of student life: student groups, historically agents of progressive change, have become tools of political patronage, undermining the development of a forward-looking, employable youth population.

This long-standing neglect has created a large pool of low-skilled labour-unsuited for a knowledge-intensive, globally competitive economy. Unless Bangladesh radically improves the quality and relevance of its education system, it will fail to generate the human capital necessary to attract high-value FDI.

Bangladesh's disappointing FDI record is not a function of bad luck or immutable geography. It is the product of avoidable policy failures. The experiences of Vietnam and Mexico demonstrate that with strategic vision, institutional reform, trade openness, and investments in human capital, countries can transcend initial disadvantages and become investment hubs. Bangladesh must shed its complacency and embrace a reform agenda that is bold, sustained, and coherent.

The window of opportunity is narrowing. As global value chains reorganise in response to geopolitical shifts and technological disruption, investors are scouting for reliable, efficient, and responsive partners. Bangladesh has the potential to be one of them. But potential means little without execution. Reform-not resignation-is the only viable path forward.

Dr M G Quibria is a development economist and former Senior Advisor at the Asian Development Bank Institute. His academic career spans institutions across three continents.