- Copy to clipboard

- Thread starter

- #501

Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,865

- Points

- 209

- Nation

- Residence

- Axis Group

A six-month progress report on the govt's economic record

Economic struggles and some successes mark the first 6 months of the interim government.

A six-month progress report on the govt's economic record

VISUAL: SIFAT AFRIN SHAMS

The interim government (IG) headed by Dr Yunus is already facing some headwinds as it prepares to celebrate the first six months of its term on February 8. It has been fighting tooth and nail to contain inflation, solve the banking crisis, and reduce the budget gap. While the successes of the IG in these three areas are slow to come, social and print media have also highlighted some of the IG's economic and administrative setbacks. However, one also has to weigh the hurdles that the IG had to face and overcome. The transition of power was hardly smooth. Compared to other countries where autocratic regimes were recently deposed and the economies bounced back, particularly the Intifada in Syria or "Aragalaya" ("people's struggle") in Sri Lanka, Bangladesh is not doing too poorly.

The looming parliamentary election in Bangladesh is casting a long shadow over the country's political economy and on every move of the IG. Electioneering has already made an impact on the programmes launched by the interim government. Political parties are jockeying for power and publicly announcing that they can do better than the IG. Members of the various committees convened by the IG are also now openly pushing for their own points of view.

If it provides any solace to the IG, even a very popularly elected new administration often faces critics who are not gun-shy. Take the case of the US. On January 23, only three days after Trump's inauguration as the president, The New York Times ran an op-ed, "Trump Is Already Making America Weaker and More Vulnerable." The well-regarded columnist Nicholas Kristof, wrote that Trump's executive orders on the first day to allow TikTok to operate, withdraw from the Paris Agreement and the World Health Organisation, and tighten border security have put the lives of Americans at risk. It is well-known that the media "experts" are often prone to hyperbole, and you can never win them all.

Fortunately, nobody, not even diehard Awami League supporters, can proclaim publicly that the IG has made Bangladesh weaker. The IG has managed to contain dengue fever, is trying hard to manage inflation, and is making our borders secure. So, where is all the criticism targeting the IG coming from? I will only focus here today on a few of its economic vulnerabilities.

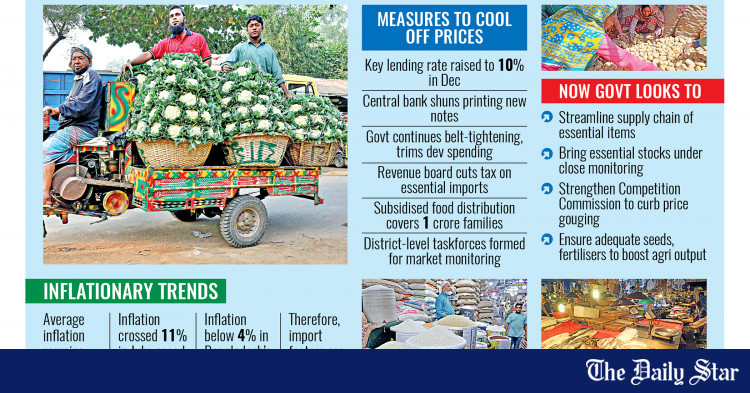

As mentioned, curbing inflation and raising revenue are two of the IG's toughest challenges. If the only goal was to curb inflation, the IG could use all the levers of monetary and fiscal policies, including higher interest rates, raising taxes, and curtailing government expenditures. It has done all of these. However, these steps are not popular and might conflict with the other goals—raising revenue, boosting investment, repairing the physical infrastructure, and providing social services.

The interim government recently raised VAT on several essential items. Being an indirect form of taxation, raising VAT will adversely affect the average consumer, and might trigger further inflation. Whether the increase was made in response to pressures from the International Monetary Fund (IMF) or as a short-term measure to close the shortage in its revenue collection, the IG needs to focus on tightening income and corporate tax loopholes.

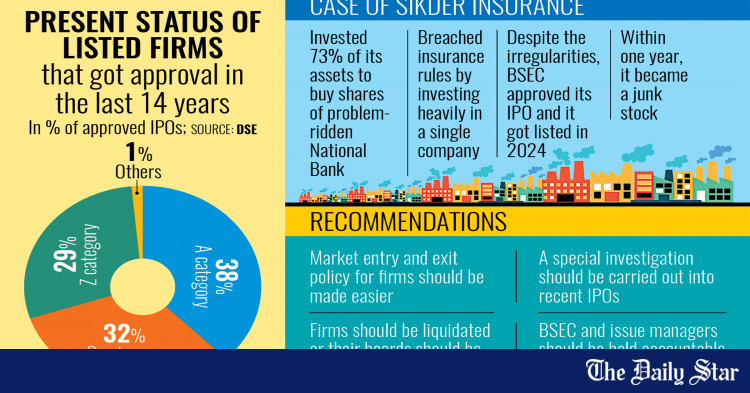

The Daily Star published an editorial on January 20, "What was the point of a white paper on economy?" and advised the IG to take immediate actions based on the panel's recommendations. The editorial aptly reflects the views of many scholars and some concerned citizens. However, after a careful review of the white paper, I found that most of the recommendations are not specific enough and require vetting before the IG can take policy actions based on them. Some measures taken by the IG after it assumed power have already shown some results, including banking reforms, foreign exchange control, and providing support to the victims of the July uprising.

It is possible that the IG only has one more year before it becomes a "lame-duck" administration once elections are announced. After that, the complex political dynamics and the mood of the stakeholders will change. The legitimacy of the IG is already being questioned, and its actions may face more pushback. One has to wonder how much can be achieved in terms of reforms and economic growth in such a fraught environment.

The budget for FY2025-26 will be challenging. The previous government's imprint on the current budget is evident. It left a legacy of corruption and give-outs thanks to the megaprojects, and the lion's share of next year's budget will go to debt servicing. Balancing the development budget and providing a friendly investment climate will also require a lot of creativity from the finance adviser.

Higher interest rates, energy crises, and law enforcement issues have also raised uncertainty in supply chains. Business leaders of the country have called upon the IG to engage in more frequent dialogues and work closely with entrepreneurs and industrialists to foster a business-friendly environment. Finance Adviser Salehuddin Ahmed acknowledged this in a recent gathering organised by the American Chamber of Commerce in Bangladesh (AmCham). "We have to create a business-friendly foreign exchange market, credit flow, regulatory regime, and revenue customs tax," he said.

The white paper has made a set of recommendations to stabilise the economy. The country needs institutional reforms in the banking, energy, and the financial sector, as we all agree. The white paper recommends raising the tax rate on higher-income individuals and the corporate sector. Domestic resource mobilisation has been lagging and raising direct taxes is a recommended pathway. According to various sources, the National Board of Revenue is currently working on this. It has also taken steps to digitalise the tax filing system. Recently the chief adviser announced, "We are gradually preparing to collect all types of taxes online," and provided plans to make tax compliance more accessible for everyone.

Bangladesh Bank governor recently said the IG has set a target to reduce inflation to seven percent by the end of June and eventually below five percent in the next fiscal year. Unfortunately, the public may not see the benefits right away. Every month the BB has to assess data in real time. To quote Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, US, "It's hard to know for sure how things are going to evolve on a week-to-week or month-to-month basis." The US Fed has the world's best tools to gauge inflation, and tons of staff pouring over data and using some of the coolest models. So, the impact of the policies to curtail inflation in Bangladesh may take a little longer to manifest itself, and the impact may be felt probably after Ramadan.

There has been some progress initiated by the banking sector reform task force. To shore up the failing banks, asset quality review is in progress, and BB has hired auditors including some of the Big Four accounting firms.

The biggest challenge the IG will have to handle in the coming weeks is the election schedule. On January 24 at a World Economic Forum meeting, the chief adviser said that the government is waiting to hold elections, but the people have to decide whether they want a short-agenda or a longer-agenda in terms of reform. "If people want quick reforms, then we have set a target to hold elections by the end of this year. And if they say, no—we need long-term reforms; then we will need another six months," he said.

Dr Abdullah Shibli is an economist and works for Change Healthcare, Inc, an information technology company. He also serves as senior research fellow at the US-based International Sustainable Development Institute (ISDI).

VISUAL: SIFAT AFRIN SHAMS

The interim government (IG) headed by Dr Yunus is already facing some headwinds as it prepares to celebrate the first six months of its term on February 8. It has been fighting tooth and nail to contain inflation, solve the banking crisis, and reduce the budget gap. While the successes of the IG in these three areas are slow to come, social and print media have also highlighted some of the IG's economic and administrative setbacks. However, one also has to weigh the hurdles that the IG had to face and overcome. The transition of power was hardly smooth. Compared to other countries where autocratic regimes were recently deposed and the economies bounced back, particularly the Intifada in Syria or "Aragalaya" ("people's struggle") in Sri Lanka, Bangladesh is not doing too poorly.

The looming parliamentary election in Bangladesh is casting a long shadow over the country's political economy and on every move of the IG. Electioneering has already made an impact on the programmes launched by the interim government. Political parties are jockeying for power and publicly announcing that they can do better than the IG. Members of the various committees convened by the IG are also now openly pushing for their own points of view.

If it provides any solace to the IG, even a very popularly elected new administration often faces critics who are not gun-shy. Take the case of the US. On January 23, only three days after Trump's inauguration as the president, The New York Times ran an op-ed, "Trump Is Already Making America Weaker and More Vulnerable." The well-regarded columnist Nicholas Kristof, wrote that Trump's executive orders on the first day to allow TikTok to operate, withdraw from the Paris Agreement and the World Health Organisation, and tighten border security have put the lives of Americans at risk. It is well-known that the media "experts" are often prone to hyperbole, and you can never win them all.

Fortunately, nobody, not even diehard Awami League supporters, can proclaim publicly that the IG has made Bangladesh weaker. The IG has managed to contain dengue fever, is trying hard to manage inflation, and is making our borders secure. So, where is all the criticism targeting the IG coming from? I will only focus here today on a few of its economic vulnerabilities.

As mentioned, curbing inflation and raising revenue are two of the IG's toughest challenges. If the only goal was to curb inflation, the IG could use all the levers of monetary and fiscal policies, including higher interest rates, raising taxes, and curtailing government expenditures. It has done all of these. However, these steps are not popular and might conflict with the other goals—raising revenue, boosting investment, repairing the physical infrastructure, and providing social services.

The interim government recently raised VAT on several essential items. Being an indirect form of taxation, raising VAT will adversely affect the average consumer, and might trigger further inflation. Whether the increase was made in response to pressures from the International Monetary Fund (IMF) or as a short-term measure to close the shortage in its revenue collection, the IG needs to focus on tightening income and corporate tax loopholes.

The Daily Star published an editorial on January 20, "What was the point of a white paper on economy?" and advised the IG to take immediate actions based on the panel's recommendations. The editorial aptly reflects the views of many scholars and some concerned citizens. However, after a careful review of the white paper, I found that most of the recommendations are not specific enough and require vetting before the IG can take policy actions based on them. Some measures taken by the IG after it assumed power have already shown some results, including banking reforms, foreign exchange control, and providing support to the victims of the July uprising.

It is possible that the IG only has one more year before it becomes a "lame-duck" administration once elections are announced. After that, the complex political dynamics and the mood of the stakeholders will change. The legitimacy of the IG is already being questioned, and its actions may face more pushback. One has to wonder how much can be achieved in terms of reforms and economic growth in such a fraught environment.

The budget for FY2025-26 will be challenging. The previous government's imprint on the current budget is evident. It left a legacy of corruption and give-outs thanks to the megaprojects, and the lion's share of next year's budget will go to debt servicing. Balancing the development budget and providing a friendly investment climate will also require a lot of creativity from the finance adviser.

Higher interest rates, energy crises, and law enforcement issues have also raised uncertainty in supply chains. Business leaders of the country have called upon the IG to engage in more frequent dialogues and work closely with entrepreneurs and industrialists to foster a business-friendly environment. Finance Adviser Salehuddin Ahmed acknowledged this in a recent gathering organised by the American Chamber of Commerce in Bangladesh (AmCham). "We have to create a business-friendly foreign exchange market, credit flow, regulatory regime, and revenue customs tax," he said.

The white paper has made a set of recommendations to stabilise the economy. The country needs institutional reforms in the banking, energy, and the financial sector, as we all agree. The white paper recommends raising the tax rate on higher-income individuals and the corporate sector. Domestic resource mobilisation has been lagging and raising direct taxes is a recommended pathway. According to various sources, the National Board of Revenue is currently working on this. It has also taken steps to digitalise the tax filing system. Recently the chief adviser announced, "We are gradually preparing to collect all types of taxes online," and provided plans to make tax compliance more accessible for everyone.

Bangladesh Bank governor recently said the IG has set a target to reduce inflation to seven percent by the end of June and eventually below five percent in the next fiscal year. Unfortunately, the public may not see the benefits right away. Every month the BB has to assess data in real time. To quote Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, US, "It's hard to know for sure how things are going to evolve on a week-to-week or month-to-month basis." The US Fed has the world's best tools to gauge inflation, and tons of staff pouring over data and using some of the coolest models. So, the impact of the policies to curtail inflation in Bangladesh may take a little longer to manifest itself, and the impact may be felt probably after Ramadan.

There has been some progress initiated by the banking sector reform task force. To shore up the failing banks, asset quality review is in progress, and BB has hired auditors including some of the Big Four accounting firms.

The biggest challenge the IG will have to handle in the coming weeks is the election schedule. On January 24 at a World Economic Forum meeting, the chief adviser said that the government is waiting to hold elections, but the people have to decide whether they want a short-agenda or a longer-agenda in terms of reform. "If people want quick reforms, then we have set a target to hold elections by the end of this year. And if they say, no—we need long-term reforms; then we will need another six months," he said.

Dr Abdullah Shibli is an economist and works for Change Healthcare, Inc, an information technology company. He also serves as senior research fellow at the US-based International Sustainable Development Institute (ISDI).