ECONOMIC RECOVERY

Sluggish investment, joblessness persist

Shakhawat Hossain 05 August, 2025, 00:01

File photo

The interim government has checked to some extent macroeconomic headwinds it inherited from the ousted Awami League regime, but failed to infuse enough dynamism into the economy to overcome sluggish private sector investment and unemployment over the past one year.

After taking office on August 8, 2024, the interim government went for rebuilding the economy shattered by political figures and Awami League-linked businesses during the ousted regime.

The looting of banks, corruption and economic mismanagement had pushed the economy to its nadir during the authoritarian AL regime which was toppled on August 5, 2024, in a mass uprising.

Economists lauded the economic policymakers under the interim government for securing record amount of $3.6 billion budget supports from the multilateral and bilateral lenders to make up for the revenue shortfall of about 1 lakh crore and rebuilding the foreign currency reserve which had faced serious strains since the middle of 2022.

Buoyant by a record growth in remittance and a positive growth in export, the interim government has made an early turnaround in external trade position.

The current account balance improved at $432.0 million negative during the July-May period of the past financial year of FY25 from $6,116 million negative during the same period of FY24, thanks to a 26 per cent year-on-year growth in remittance and 9 per cent growth in exports until FY25.

The foreign exchange reserve reached $24.54 billion in July 10, 2025, from $21.06 billion one year back.

But the improvement in foreign exchange reserves and almost a stable currency exchange rate could not dispel shakiness by the businesses over new investment, which is evident in less credit growth in the private sector, the main driving force of the economy.

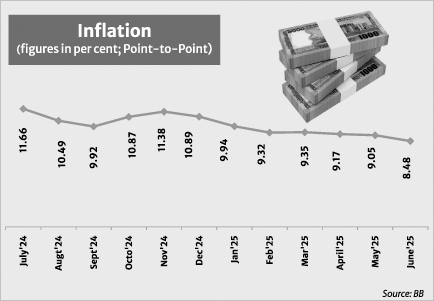

Besides, rising poverty amid elevated inflation of 9 per cent, political uncertainty, sliding law and order situation marked by frequent mob violence incidents and the new US tariff policy have caused more concerns for the interim government on way to a full-fledged macroeconomic recovery.

Finance adviser Saleuddin Ahmed on July 15 told New Age that they had been able to stop the rot that had pushed the economy to its nadir.New Age specials

‘The macroeconomic situation has been stabilised,’ he said, adding that further improvements would come in the economy later.

Referring to a 3.97 per cent growth in the gross domestic product, the weakest since 3.45 per cent recorded in the Covid pandemic-hit 2020-21 financial year, Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development, an independent research organisation, said that the economy could not be freed from a low-level of performances.

He said that the overall imports recorded 4.66 per cent growth in the July-May period of FY25 from 10.61 per cent negative growth in the same period of FY24, but that could not stop the falling imports of capital machinery and intermediate goods necessary for industrial production.

A Bangladesh Bank Update released on July 10 showed that the import of capital machinery recorded 25.56 per cent negative in the July-April period of FY25 from 23.86 per cent negative in the same period of FY24 and that of intermediate goods 8 per cent negative from 12 per cent negative.

The number of unemployed people in the country increased to 27.3 lakh in the fourth quarter of 2024 compared with that of 24 lakh in the same period of 2023, according to the Bangladesh Bureau of Statistics.

The unemployment rate climbed to 4.63 per cent in the October-December period of 2024 compared with that of 3.95 per cent in the same period of 2023.

Economists have identified a less than 7 per cent credit growth to the private sector in the July-May period of FY25 against the backdrop of disruptions to business activities in the more than one-month-long mass uprising, sliding law and order and political uncertainty for the weak economic activities.

Blaming slow and tinkered reforms in the areas of banking, revenue, fiscal and trade and investment, the economists said that the interim government had wasted a rare opportunity that came along after the July uprising to make visible and quick progresses on the economic front.

‘Unlike the political front, nobody opposes the swift reform on the economic side,’ said M Masrur Reaz, chairman and chief executive officer of the Policy Exchange Bangladesh, an independent advisory firm.

Noting the failure in bringing about positive changes in trade and investment over the past one year, he said that employment and private sector investments had been adversely impacted.

One in every four persons in the country is poor and about 3.98 crore individuals are suffering multidimensional poverty, according to the Multidimensional Poverty Index released by the General Economics Division on July 31.

An additional 30 lakh people in Bangladesh are expected to fall into extreme poverty in the current calendar year, as the rate is projected to rise from 7.7 per cent to 9.3 per cent, according to the Bangladesh Development Update released by the World Bank in April.

The WB forecast that the weak situation in the labour market would continue in the current year, while general people, particularly those vulnerable to extreme poverty, might register a decline in their income.

The discouraging outlook by the WB was disseminated just after the US president Donald Trump announced ‘reciprocal’ tariffs against its trading countries, including Bangladesh.

The US president had put the rate for Bangladesh at 35 per cent, but lowered it to 20 per cent following three rounds of tariff talks between Dhaka and Washington and Bangladesh’s moves to reduce trade deficit between the two countries. The rate initially announced by the Trump administration was 37 per cent.

In 2024, Bangladesh exported goods worth about $8.4 billion to the US, its single biggest export market. Of the export earnings, $7.34 billion accounted for readymade garments. In the year, the country imported US goods worth $2.2 billion.

Former World Bank Dhaka office chief economist Zahid Hussain said that the lowered tariff rate had created an upside opportunity for Bangladesh.

Bangladesh finds itself with a notable tariff advantage over India and nearly on an equal footing with countries like Pakistan, Vietnam, Indonesia and the Philippines, said the economist.