Saif

Senior Member

- Messages

- 17,522

- Likes

- 8,438

- Nation

- Residence

- Axis Group

Forex market on the mend as remittances rebound

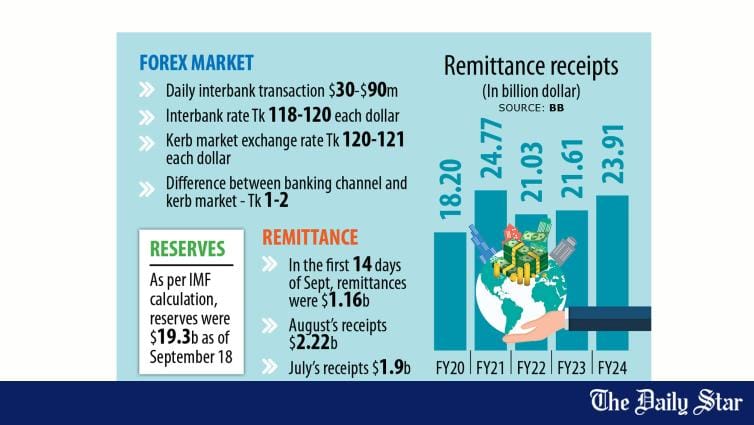

After a prolonged period of crisis, the foreign exchange market in Bangladesh, especially the interbank forex market, is showing signs of recovery, driven by a rebound in remittance receipts and key policy interventions by the central bank.

Forex market on the mend as remittances rebound

After a prolonged period of crisis, the foreign exchange market in Bangladesh, especially the interbank forex market, is showing signs of recovery, driven by a rebound in remittance receipts and key policy interventions by the central bank.

The interbank forex market, which is crucial in facilitating international trade, had been under huge pressure lately owing to a crisis of US dollars, which was triggered by a combination of high import bills, lower-than-expected remittance inflows, and dwindling foreign exchange reserves.

However, the recent rebound in remittance inflows and some key policy decisions, such as the adoption of a crawling peg exchange rate system, are helping normalise the interbank forex trade.

"The interbank forex market is moving towards a stable phase riding on the strong rebound of remittance inflows," said Md Shaheen Iqbal, head of treasury and financial institutions at BRAC Bank Limited.

He added that the foreign exchange crisis is easing and the interbank forex market is functioning more smoothly.

Remittance inflows, a major source of foreign currency for Bangladesh, fell to a 10-month low in July, when the Awami League government imposed a five-day internet blackout to quell protests centring the students' quota reform movement.

However, receipts began to pick up again after former prime minister Sheikh Hasina fled to India on August 5 as many expatriates started campaigns to send money through formal channels to build the country.

Remittance receipts climbed 16.10 percent in August compared to the month prior, hitting $2.2 billion.

In the first 14 days of September, remittance receipts reached around $1.17 billion, as per central bank data.

Riding on higher remittance inflows, the country's foreign exchange reserves are now showing signs of recovery. The foreign exchange reserves stood at nearly $20 billion as of Tuesday, according to the BPM-6 calculation standard of the International Monetary Fund (IMF).

Another benefit of increased inflows is that banks can now trade among themselves smoothly in the interbank forex market, Husne Ara Shikha, spokesperson of the Bangladesh Bank, told the media last week.

The price of the US dollar will also stabilise as the interbank forex transactions are active, she added.

Apart from rising remittances, some measures adopted by the central bank, including the introduction of the crawling peg, have also had a positive impact on the interbank forex market, said Mohammad Shams-Ul Islam, former managing director of Agrani Bank.

The Bangladesh Bank introduced the crawling peg, which allows the currency to adjust exchange rates based on demand and supply, on May 8 this year.

This move has reduced volatility in the market and helped narrow the gap between the US dollar price in the formal banking sector and the kerb market, Islam said.

Currently, the difference in US dollar prices between banking channels and the kerb market stands at about Tk 1 to Tk 2. Each dollar is sold for Tk 118-120 on the interbank forex market while it fetches Tk 120 to Tk 121 in the open market, according to market insiders.

Besides, after taking charge as the Bangladesh Bank governor, economist Ahsan H Mansur has taken some steps such as by reconstituting the boards of different crisis-hit banks.

He also stopped providing liquidity support to banks from the foreign exchange reserves.

These moves have restored the confidence of depositors, remitters and businesses in the banking sector, thereby improving the overall flow of interbank foreign exchange within the country, said Islam, former managing director of Agrani Bank.

As an example, he said, banks like the Bangladesh Krishi Bank, which receive a good amount of remittance but do not face pressure to open letters of credit (LCs), are supplying dollars to the interbank market, reducing the pressure on banks that deal with dollar-based trading.

As a result of sufficient dollar flow to the interbank market, the pressure on LC openings has reduced drastically, he added.

BRAC Bank's Shaheen Iqbal said now there is some surplus in the interbank market after meeting the demand for LCs.

"This is a significant positive trend," he said, estimating that daily transactions in the interbank forex market stood between $30 million and $90 million.

The interbank market will be fully operational after the government clears its outstanding import bills, Iqbal added.

After a prolonged period of crisis, the foreign exchange market in Bangladesh, especially the interbank forex market, is showing signs of recovery, driven by a rebound in remittance receipts and key policy interventions by the central bank.

The interbank forex market, which is crucial in facilitating international trade, had been under huge pressure lately owing to a crisis of US dollars, which was triggered by a combination of high import bills, lower-than-expected remittance inflows, and dwindling foreign exchange reserves.

However, the recent rebound in remittance inflows and some key policy decisions, such as the adoption of a crawling peg exchange rate system, are helping normalise the interbank forex trade.

"The interbank forex market is moving towards a stable phase riding on the strong rebound of remittance inflows," said Md Shaheen Iqbal, head of treasury and financial institutions at BRAC Bank Limited.

He added that the foreign exchange crisis is easing and the interbank forex market is functioning more smoothly.

Remittance inflows, a major source of foreign currency for Bangladesh, fell to a 10-month low in July, when the Awami League government imposed a five-day internet blackout to quell protests centring the students' quota reform movement.

However, receipts began to pick up again after former prime minister Sheikh Hasina fled to India on August 5 as many expatriates started campaigns to send money through formal channels to build the country.

Remittance receipts climbed 16.10 percent in August compared to the month prior, hitting $2.2 billion.

In the first 14 days of September, remittance receipts reached around $1.17 billion, as per central bank data.

Riding on higher remittance inflows, the country's foreign exchange reserves are now showing signs of recovery. The foreign exchange reserves stood at nearly $20 billion as of Tuesday, according to the BPM-6 calculation standard of the International Monetary Fund (IMF).

Another benefit of increased inflows is that banks can now trade among themselves smoothly in the interbank forex market, Husne Ara Shikha, spokesperson of the Bangladesh Bank, told the media last week.

The price of the US dollar will also stabilise as the interbank forex transactions are active, she added.

Apart from rising remittances, some measures adopted by the central bank, including the introduction of the crawling peg, have also had a positive impact on the interbank forex market, said Mohammad Shams-Ul Islam, former managing director of Agrani Bank.

The Bangladesh Bank introduced the crawling peg, which allows the currency to adjust exchange rates based on demand and supply, on May 8 this year.

This move has reduced volatility in the market and helped narrow the gap between the US dollar price in the formal banking sector and the kerb market, Islam said.

Currently, the difference in US dollar prices between banking channels and the kerb market stands at about Tk 1 to Tk 2. Each dollar is sold for Tk 118-120 on the interbank forex market while it fetches Tk 120 to Tk 121 in the open market, according to market insiders.

Besides, after taking charge as the Bangladesh Bank governor, economist Ahsan H Mansur has taken some steps such as by reconstituting the boards of different crisis-hit banks.

He also stopped providing liquidity support to banks from the foreign exchange reserves.

These moves have restored the confidence of depositors, remitters and businesses in the banking sector, thereby improving the overall flow of interbank foreign exchange within the country, said Islam, former managing director of Agrani Bank.

As an example, he said, banks like the Bangladesh Krishi Bank, which receive a good amount of remittance but do not face pressure to open letters of credit (LCs), are supplying dollars to the interbank market, reducing the pressure on banks that deal with dollar-based trading.

As a result of sufficient dollar flow to the interbank market, the pressure on LC openings has reduced drastically, he added.

BRAC Bank's Shaheen Iqbal said now there is some surplus in the interbank market after meeting the demand for LCs.

"This is a significant positive trend," he said, estimating that daily transactions in the interbank forex market stood between $30 million and $90 million.

The interbank market will be fully operational after the government clears its outstanding import bills, Iqbal added.