- Copy to clipboard

- Thread starter

- #41

Power, communication sectors’ reform underway: adviser

Adviser to the interim government Muhammad Fouzul Kabir Khan on Thursday said that the government had embarked reforming the power, energy, road, bridges and railway sectors to fulfil the expectation of the people...

www.newagebd.net

www.newagebd.net

Power, communication sectors’ reform underway: adviser

Bangladesh Sangbad Sangstha . Dhaka 12 September, 2024, 22:54

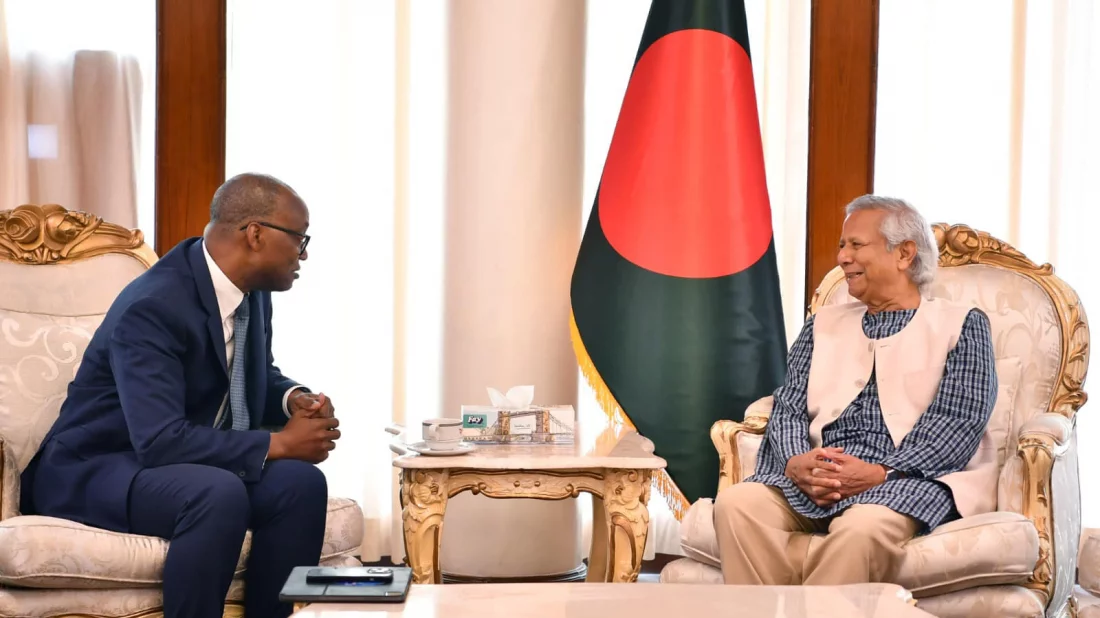

Foreign Investors’ Chamber of Commerce and Industry’s board of directors held a meeting with power, energy, and mineral resources adviser Muhammad Fouzul Kabir Khan on Thursday. Among others, FICCI president Zaved Akhtar was present. | Press release

Adviser to the interim government Muhammad Fouzul Kabir Khan on Thursday said that the government had embarked reforming the power, energy, road, bridges and railway sectors to fulfil the expectation of the people.

‘Different agencies or companies linked with the ministries of power, energy, road, bridges and railways are being reformed and renovated in an effort to fulfil peoples dream’, he said.

The adviser said this on the day in a meeting with a group of representatives of Foreign Investors’

Chamber of Commerce and Industry led by its president Javed Akhter at the Secretariat.

During the meeting, the adviser said that unbridled corruption, unfairness, injustice and inequality during the recent past regime led the students and common masses to forge movement to unseat the fascist government and constitute a new government to build a new nation.

‘The dream came true in exchange of huge sacrifice and we are now working to materialise the dream of the martyrs,’ Kabir added.

Seeking all out cooperation from the apex body of the foreign investors, Fouzul Kabir said, the people of the country want to see a discrimination-free new Bangladesh.

‘So, I hope that the apex body will enhance their support to the incumbent government for safeguarding the peoples’ interests and building a new Bangladesh,’ he said.

Senior vice-president Eric M Walker, vice-president Yasir Ajman, executive director TIM Nurul Kabir were included in the FICCI delegation.

Senior secretary of the Road Transport and Highway Division M Ehsanul Huq, Power Division senior secretary M Habibur Rahman, Energy and Mineral Resources Division senior secretary M Nurul Alam were present.

Assuring the interim government of extending all cooperation, FICCI president Javed Akhter said that they wanted to contribute in building a discrimination-free new Bangladesh by doing business with utmost honesty and sincerity.

Bangladesh Sangbad Sangstha . Dhaka 12 September, 2024, 22:54

Foreign Investors’ Chamber of Commerce and Industry’s board of directors held a meeting with power, energy, and mineral resources adviser Muhammad Fouzul Kabir Khan on Thursday. Among others, FICCI president Zaved Akhtar was present. | Press release

Adviser to the interim government Muhammad Fouzul Kabir Khan on Thursday said that the government had embarked reforming the power, energy, road, bridges and railway sectors to fulfil the expectation of the people.

‘Different agencies or companies linked with the ministries of power, energy, road, bridges and railways are being reformed and renovated in an effort to fulfil peoples dream’, he said.

The adviser said this on the day in a meeting with a group of representatives of Foreign Investors’

Chamber of Commerce and Industry led by its president Javed Akhter at the Secretariat.

During the meeting, the adviser said that unbridled corruption, unfairness, injustice and inequality during the recent past regime led the students and common masses to forge movement to unseat the fascist government and constitute a new government to build a new nation.

‘The dream came true in exchange of huge sacrifice and we are now working to materialise the dream of the martyrs,’ Kabir added.

Seeking all out cooperation from the apex body of the foreign investors, Fouzul Kabir said, the people of the country want to see a discrimination-free new Bangladesh.

‘So, I hope that the apex body will enhance their support to the incumbent government for safeguarding the peoples’ interests and building a new Bangladesh,’ he said.

Senior vice-president Eric M Walker, vice-president Yasir Ajman, executive director TIM Nurul Kabir were included in the FICCI delegation.

Senior secretary of the Road Transport and Highway Division M Ehsanul Huq, Power Division senior secretary M Habibur Rahman, Energy and Mineral Resources Division senior secretary M Nurul Alam were present.

Assuring the interim government of extending all cooperation, FICCI president Javed Akhter said that they wanted to contribute in building a discrimination-free new Bangladesh by doing business with utmost honesty and sincerity.