Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 17,262

- Likes

- 8,334

- Nation

- Residence

- Axis Group

What the budget says about reforms?

The finance adviser noted a comprehensive package of reform measures for restoring good governance, ensuring institutional accountability, and rebuilding a crumbling financial system.

What the budget says about reforms?

Staff Correspondent Dhaka

Published: 02 Jun 2025, 18: 16

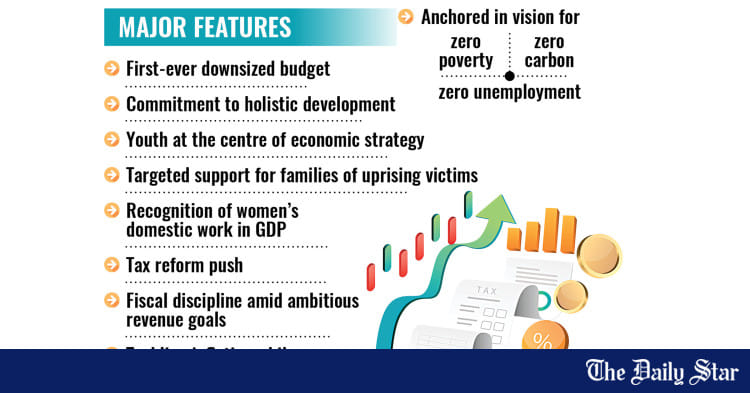

Finance adviser Salehuddin Ahmed has presented the annual budget for 2025-26 fiscal year, with a comprehensive package of reform measures for restoring good governance, ensuring institutional accountability, and rebuilding a crumbling financial system.

In his budget speech, the finance adviser noted that the institutions have been severely weakened over the past one and a half decades due to widespread corruption and poor governance. He noted the reform commission reports and the interim government’s action plan in this regard.

Tackling corruption and strengthening accountability

Salehuddin Ahmed mentioned that the interim government has initiated amendments to the Anti-Corruption Commission Act, 2004. Between July 2024 and January 2025, 515 corruption cases were registered and 814 charge sheets submitted. Of 144 disposed cases, 59 led to convictions.

In line with the United Nations Convention Against Corruption (UNCAC), steps are being taken to recover laundered money from abroad. Recommendations by the Anti-Corruption Commission Reform Commission and findings from the White Paper on past corruption are being integrated into new policy measures.

Land, judiciary, and electoral reforms

To simplify land-related services and reduce litigation, the government has adopted the 'Land Offences Prevention and Remedy Rules, 2024', and is drafting the 'Land Zoning and Protection Act, 2025'. A digital land management system is being introduced to automate records and registration, leading to improved transparency and revenue collection.

Judicial reforms have also been prioritised. Thirteen monitoring committees comprising 13 High Court judges now oversee subordinate courts to speed up case disposal. The Supreme Court Judicial Appointment Ordinance, 2025 aims to ensure transparency in judicial appointments. An international-standard judicial academy is being established to provide modern training to court officials.

In terms of electoral reforms, the Bangladesh Election Commission has updated the voter list and is using Geographic Information System (GIS) technology to enhance transparency and accuracy. Legal amendments have also been made to prevent manipulation in future elections.

The interim government is also addressing injustices over the student-people movement in 2024. Many politically motivated and fabricated cases filed under the Anti-Terrorism Act and the Cyber Security Act are being withdrawn. To prosecute crimes against humanity committed during that time, the government has enacted the International Crimes (Tribunals) (Amendment) Ordinance, 2024, aligning it with the Rome Statute and international legal norms.

Financial sector reforms

Describing the financial sector as being on the verge of collapse due to 15 years of mismanagement, the finance adviser highlighted sweeping reforms to restore confidence and ensure accountability. The boards of several banks have been restructured, and the Bank Resolution Ordinance, 2025 has been enacted to deal with insolvency and liquidity crises. The Bangladesh Bank Ordinance, 1972 is being amended, and a weak asset management law is in development.

Three task forces are overseeing key aspects of banking reform—assessing asset quality, boosting regulatory capacity, and recovering stolen or laundered funds. Besides, the Bangladesh Bank has formed a financial stability committee to understand the dynamics of the financial sector and determine the steps to be taken to maintain the stability of the financial system.

Staff Correspondent Dhaka

Published: 02 Jun 2025, 18: 16

Finance adviser Salehuddin Ahmed has presented the annual budget for 2025-26 fiscal year, with a comprehensive package of reform measures for restoring good governance, ensuring institutional accountability, and rebuilding a crumbling financial system.

In his budget speech, the finance adviser noted that the institutions have been severely weakened over the past one and a half decades due to widespread corruption and poor governance. He noted the reform commission reports and the interim government’s action plan in this regard.

Tackling corruption and strengthening accountability

Salehuddin Ahmed mentioned that the interim government has initiated amendments to the Anti-Corruption Commission Act, 2004. Between July 2024 and January 2025, 515 corruption cases were registered and 814 charge sheets submitted. Of 144 disposed cases, 59 led to convictions.

In line with the United Nations Convention Against Corruption (UNCAC), steps are being taken to recover laundered money from abroad. Recommendations by the Anti-Corruption Commission Reform Commission and findings from the White Paper on past corruption are being integrated into new policy measures.

Land, judiciary, and electoral reforms

To simplify land-related services and reduce litigation, the government has adopted the 'Land Offences Prevention and Remedy Rules, 2024', and is drafting the 'Land Zoning and Protection Act, 2025'. A digital land management system is being introduced to automate records and registration, leading to improved transparency and revenue collection.

Judicial reforms have also been prioritised. Thirteen monitoring committees comprising 13 High Court judges now oversee subordinate courts to speed up case disposal. The Supreme Court Judicial Appointment Ordinance, 2025 aims to ensure transparency in judicial appointments. An international-standard judicial academy is being established to provide modern training to court officials.

In terms of electoral reforms, the Bangladesh Election Commission has updated the voter list and is using Geographic Information System (GIS) technology to enhance transparency and accuracy. Legal amendments have also been made to prevent manipulation in future elections.

The interim government is also addressing injustices over the student-people movement in 2024. Many politically motivated and fabricated cases filed under the Anti-Terrorism Act and the Cyber Security Act are being withdrawn. To prosecute crimes against humanity committed during that time, the government has enacted the International Crimes (Tribunals) (Amendment) Ordinance, 2024, aligning it with the Rome Statute and international legal norms.

Financial sector reforms

Describing the financial sector as being on the verge of collapse due to 15 years of mismanagement, the finance adviser highlighted sweeping reforms to restore confidence and ensure accountability. The boards of several banks have been restructured, and the Bank Resolution Ordinance, 2025 has been enacted to deal with insolvency and liquidity crises. The Bangladesh Bank Ordinance, 1972 is being amended, and a weak asset management law is in development.

Three task forces are overseeing key aspects of banking reform—assessing asset quality, boosting regulatory capacity, and recovering stolen or laundered funds. Besides, the Bangladesh Bank has formed a financial stability committee to understand the dynamics of the financial sector and determine the steps to be taken to maintain the stability of the financial system.