- Copy to clipboard

- Moderator

- #161

Bangladesh's Summit reviewing cross-border power deals after India rule change

Bangladesh's Summit Group plans to renegotiate preliminary deals to import renewable power from India after a recent rule change by New Delhi allowed generators that exclusively export their electricity to sell locally, the utility's chairman saidwww.thedailystar.net

Bangladesh's Summit reviewing cross-border power deals after India rule change

View attachment 7719

Bangladesh's Summit Group plans to renegotiate preliminary deals to import renewable power from India after a recent rule change by New Delhi allowed generators that exclusively export their electricity to sell locally, the utility's chairman said.

India amended its power export rules less than a week after former prime minister Sheikh Hasina fled Bangladesh early this month amid deadly protests, enabling Adani Power to connect its Godda coal-fired plant -- the only generating station under contract to export all its output -- to India's domestic grid.

"After the policy change, my partners in India might be more willing to sell in India. Our company will be investing in transmission in Bangladesh and we will have to assume more risks," Summit Group Chairman Aziz Khan told Reuters.

The conglomerate, which operates over a dozen fossil fuel-based power generation plants, signed preliminary deals with Indian partners including Tata Power Renewable Energy Ltd last year to construct and source supply from 1,000 megawatts (MW) of renewable projects.

A spokesman for Tata Power declined to comment on Summit's plans.

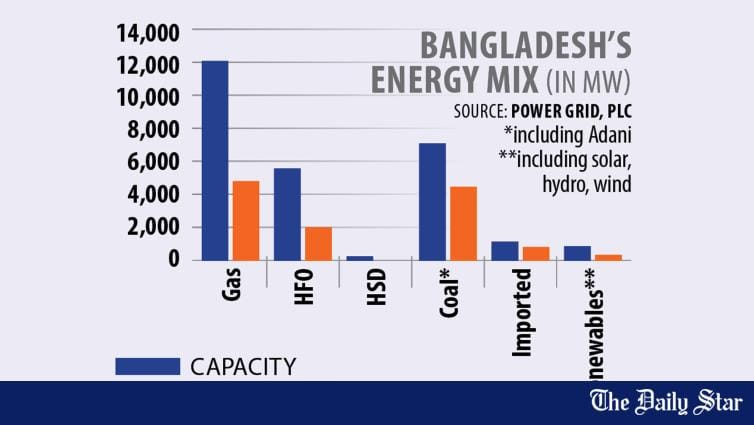

Green power imports are crucial for slashing emissions in Bangladesh, which gets nearly 99% of its electricity from fossil fuels. Land scarcity in the densely-populated country of over 170 million has constrained higher solar additions.

Summit Power International, the Singapore-based holding company for Summit Group's power generation assets, is exploring options including delaying investments until there is more policy clarity, and renegotiating financial terms to account for higher risks, Khan said.

"Such quick changes in policies are always a matter of concern as they have long-term implications," Khan said, referring to India's rule change.

Summit's plans to import clean electricity via India from 700 megawatts of hydro power plants it planned to build in Bhutan and Nepal as a part of $3 billion in regional clean power investments also face uncertainty due to a new government in Bangladesh, Khan said.

No final decisions on the cross-border investments have been taken yet, Khan said, adding that the company would continue to invest within Bangladesh.

Khan said the new Bangladesh government's decision to suspend a law allowing awards of power supply contracts without tenders also contributed to his decision to review projects.

All the brothers in Summit Group are in really intense hot water for negotiating 'unfair' power deals to benefit Hasina and Adani and indirectly, Modi's Hindutva apparatus.

One of the clauses of the signed power supply agreement between Adani and the Bangladesh PDB says that Bangladesh will be bound to pay Adani 35% of the negotiated monthly electricity charges even if Adani does not supply one unit of electricity to Bangladesh!

I am surprised the Bangladesh Govt. has not officially notified Indian Govt and the Adani organization that this agreement is null and void already....