Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 16,488

- Likes

- 8,139

- Nation

- Residence

- Axis Group

6 banks with ties to S Alam barred from lending

The Bangladesh Bank restricted six banks linked to S Alam Group from lending activities to prevent their situation from deteriorating further amid allegations of wrongdoing.

6 banks with ties to S Alam barred from lending

The Bangladesh Bank restricted six banks linked to S Alam Group from lending activities to prevent their situation from deteriorating further amid allegations of wrongdoing.

Experts say the restriction may help boost liquidity in the six cash-strapped banks, which were all running their activities by taking special liquidity support from the central bank.

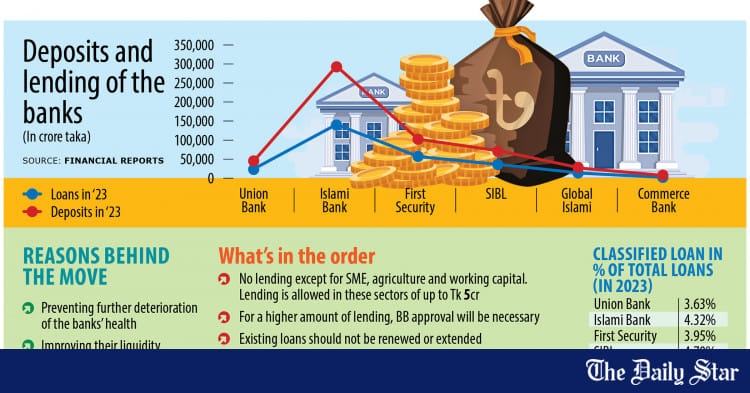

The banking regulator made the decision yesterday through a letter sent to the banks, namely Islami Bank Bangladesh, First Security Islami Bank, Social Islami Bank, Union Bank, Global Islami Bank, and Bangladesh Commerce Bank.

However, the lenders will be able to disburse agriculture loans, SME loans against deposits, and loans under incentive packages up to Tk 5 crore, the BB letter added.

In order to provide loans above Tk 5 crore, the respective bank will have to get prior approval from the central bank.

It also prohibited the six banks from rescheduling any previous loans until further notice.

Alongside that, they cannot extend or increase exisThe central bank also ordered the six banks to submit monthly repayment data of its 20 largest borrowers.

"The decision was taken in order to protect further deterioration of the banks, and protect depositors' funds," the letter sent by the central bank read.

The central bank passed the order to bring discipline to the banks, said Syed Mahbubur Rahman, a former chairman of the Association of Bankers, Bangladesh (ABB), adding that such policies had previously been issued for state-run banks.

As the banks have some liquidity issues, it may help improve the situation, he said.

The liquidity coverage ratio (LCR) of Islamic banks in Bangladesh tumbled to 58.7 percent at the end of last year from 87.7 percent in 2022 and 188.5 percent in 2021, according to a report released by Fitch Ratings, an American credit rating agency.

Excess liquidity in the sector plummeted to Tk 1,518 crore at the end of March this year, a 91.3 percent drop compared to September of 2022.

These six banks have long been battling a liquidity crisis. As such, they were utilising the central bank's special liquidity support until last week, when the central bank cut that facility.

Aside from liquidity issues, the banks are also contending with high amounts of non-performing loans (NPLs). The total bad loans of the six banks rose around 8 percent year-on-year to Tk 9,674 crore in 2023.

"We also restrict lending by some branches when we see that the NPLs of the branches are high. This is a common practice to bring back discipline," added Rahman, who is also managing director and CEO of Mutual Trust Bank.

In recent weeks, several reports have come out indicating that Mohammad Saiful Alam, the owner of S Alam Group, borrowed large amounts from these six banks using companies that exist only on paper.

Most of these loans may sour, according to experts.

There are 10 Shariah-based banks in Bangladesh, with five owned by the S Alam Group.

A top official of a leading bank said such restrictions may improve the banks' situation.

However, he cautioned that it may impact Shariah-based financing in the country as half of the Islamic banks will remain out of financing activities.

"Let the banks survive first and set aside worries about its impact on Shariah-based banking for this moment," the official said.

"There are five other Shariah-based banks in the country and two of them are doing well. So, people can go to those banks for loans in the meantime. The restriction will not remain year after year, so they will come back soon."

If the banks cannot survive, Shariah-based banking will be squeezed. So, this is a good decision, he said.

The banker hoped the banks would bounce back strongly after structural reforms and contribute to Shariah-based banking again.

As of 2023, Islamic banking assets accounted for over 25 percent of the overall banking sector's assets in Bangladesh.

However, despite impressive growth and potential, the sector has been facing a significant crisis since the middle of 2022 due to loan irregularities, scams and a lack of good governance at some Shariah-based banks.

The deposit growth of Islamic banks plummeted to 2.9 percent year-on-year in 2022 from 20.1 percent the year prior, according to the central bank's Financial Stability Report 2022.

The Bangladesh Bank restricted six banks linked to S Alam Group from lending activities to prevent their situation from deteriorating further amid allegations of wrongdoing.

Experts say the restriction may help boost liquidity in the six cash-strapped banks, which were all running their activities by taking special liquidity support from the central bank.

The banking regulator made the decision yesterday through a letter sent to the banks, namely Islami Bank Bangladesh, First Security Islami Bank, Social Islami Bank, Union Bank, Global Islami Bank, and Bangladesh Commerce Bank.

However, the lenders will be able to disburse agriculture loans, SME loans against deposits, and loans under incentive packages up to Tk 5 crore, the BB letter added.

In order to provide loans above Tk 5 crore, the respective bank will have to get prior approval from the central bank.

It also prohibited the six banks from rescheduling any previous loans until further notice.

Alongside that, they cannot extend or increase exisThe central bank also ordered the six banks to submit monthly repayment data of its 20 largest borrowers.

"The decision was taken in order to protect further deterioration of the banks, and protect depositors' funds," the letter sent by the central bank read.

The central bank passed the order to bring discipline to the banks, said Syed Mahbubur Rahman, a former chairman of the Association of Bankers, Bangladesh (ABB), adding that such policies had previously been issued for state-run banks.

As the banks have some liquidity issues, it may help improve the situation, he said.

The liquidity coverage ratio (LCR) of Islamic banks in Bangladesh tumbled to 58.7 percent at the end of last year from 87.7 percent in 2022 and 188.5 percent in 2021, according to a report released by Fitch Ratings, an American credit rating agency.

Excess liquidity in the sector plummeted to Tk 1,518 crore at the end of March this year, a 91.3 percent drop compared to September of 2022.

These six banks have long been battling a liquidity crisis. As such, they were utilising the central bank's special liquidity support until last week, when the central bank cut that facility.

Aside from liquidity issues, the banks are also contending with high amounts of non-performing loans (NPLs). The total bad loans of the six banks rose around 8 percent year-on-year to Tk 9,674 crore in 2023.

"We also restrict lending by some branches when we see that the NPLs of the branches are high. This is a common practice to bring back discipline," added Rahman, who is also managing director and CEO of Mutual Trust Bank.

In recent weeks, several reports have come out indicating that Mohammad Saiful Alam, the owner of S Alam Group, borrowed large amounts from these six banks using companies that exist only on paper.

Most of these loans may sour, according to experts.

There are 10 Shariah-based banks in Bangladesh, with five owned by the S Alam Group.

A top official of a leading bank said such restrictions may improve the banks' situation.

However, he cautioned that it may impact Shariah-based financing in the country as half of the Islamic banks will remain out of financing activities.

"Let the banks survive first and set aside worries about its impact on Shariah-based banking for this moment," the official said.

"There are five other Shariah-based banks in the country and two of them are doing well. So, people can go to those banks for loans in the meantime. The restriction will not remain year after year, so they will come back soon."

If the banks cannot survive, Shariah-based banking will be squeezed. So, this is a good decision, he said.

The banker hoped the banks would bounce back strongly after structural reforms and contribute to Shariah-based banking again.

As of 2023, Islamic banking assets accounted for over 25 percent of the overall banking sector's assets in Bangladesh.

However, despite impressive growth and potential, the sector has been facing a significant crisis since the middle of 2022 due to loan irregularities, scams and a lack of good governance at some Shariah-based banks.

The deposit growth of Islamic banks plummeted to 2.9 percent year-on-year in 2022 from 20.1 percent the year prior, according to the central bank's Financial Stability Report 2022.